Abishek Muthian

Insurers are putting the lives of sick and disabled at risk during COVID-19 pandemic

This is about Insurance companies in India, their behaviour with customers with preexisting illness. Incase you are not from India, you might still find this content useful as almost all of these companies are in tie-up with a major international insurer whom you might have your policy with.

I'm suffering from what could be best summarised in simple terms as Bone related diseases, I had a major surgery in July 2018 for ailments which has since been successfully addressed. I've been very open about my health condition to raise awareness and to support others facing such ailments.

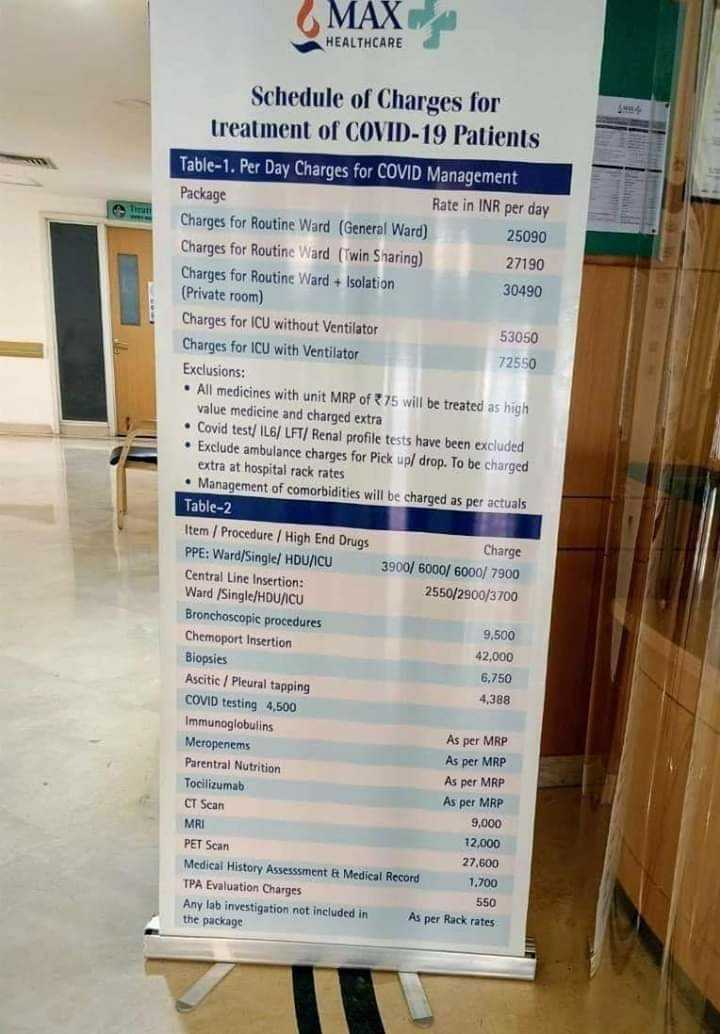

Like many others during this COVID-19 pandemic, I applied for a health insurance top-up plan as my current base plan(subscribed ~5 years ago, much before 2018 surgery) doesn't have the necessary coverage to compensate for the amount of money private hospitals are charging for COVID-19 treatment.

Since I'm an independent professional, I'm not covered under any corporate health insurance and so I had to apply for a personal health insurance policy.

I approached the top health insurance providers in the country [archive], as I believed they would be following government's guidelines regarding preexisting diseases for health insurance. I was proven wrong.

IRDAI Guidelines on preexisting diseases

Insurance Regulatory and Development Authority(IRDAI) is Indian government's regulatory body for insurance and re-insurance industries in India.

IRDAI had released several advisories regarding how the health insurance companies should treat customers with preexisting illness.

- Preexisting diseases (PED) means any condition "that is/are diagnosed by a physician within 48 months prior to the effective date of the policy issued by the insurer or its reinstatement, or for which medical advice or treatment was recommended by, or received from, a physician within 48 months prior to the effective date of the policy issued by the insurer or its reinstatement." - Amendments_guidelines_excl_std20200210.pdf [archive].

So what happens when you have preexisting disease while applying for a health insurance?

- The PED are excluded during the waiting period(maximum of 4 years). Some PEDs can be permanently excluded from the coverage of the policy - Guidelines on standardization of exclusions in HI Contracts.pdf [archive].

Note: Even permanent exclusion means those diseases are excluded from the coverage of the insurance policy and doesn't mean you should be denied the policy itself.

Insurance providers are not following IRDAI guidelines

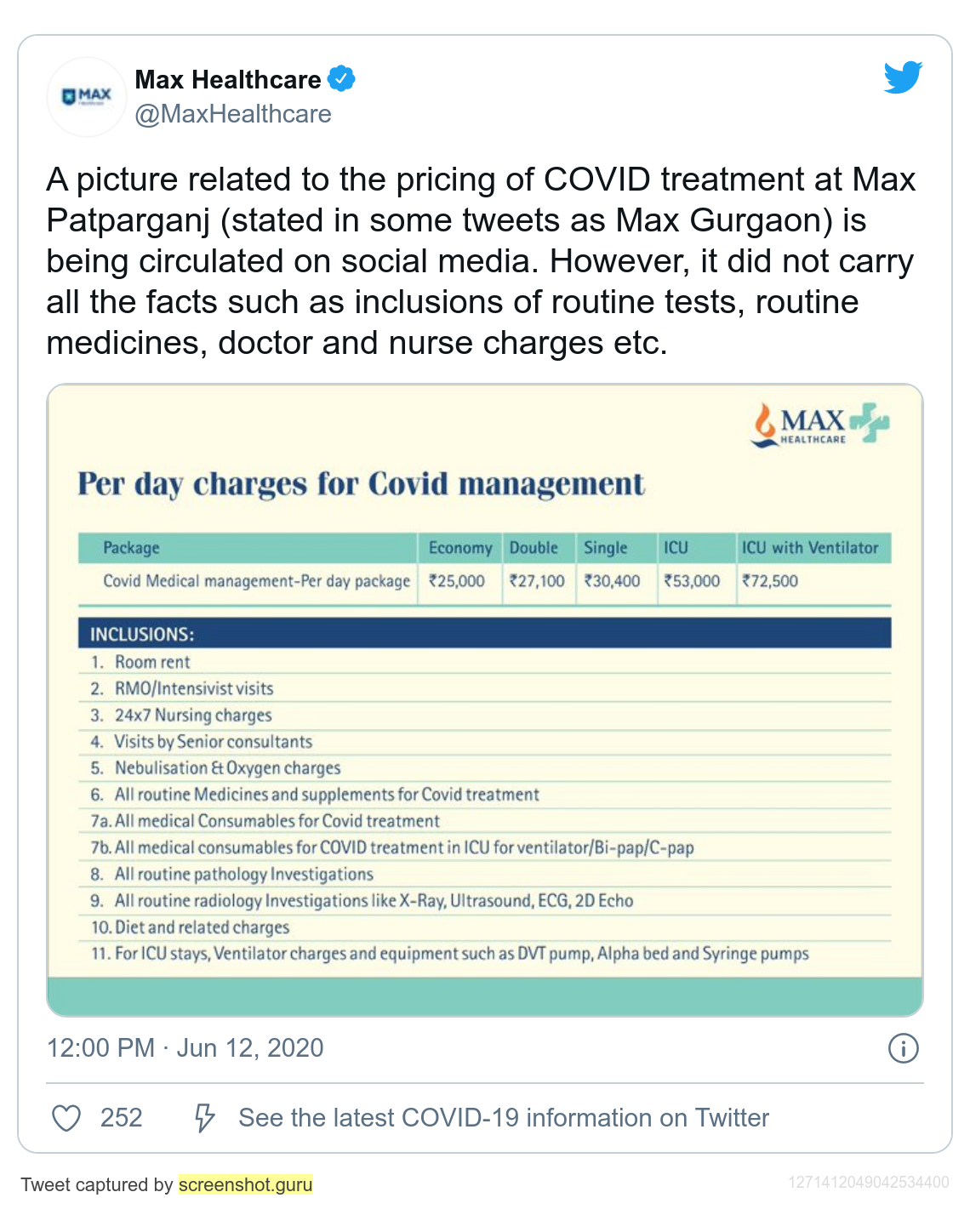

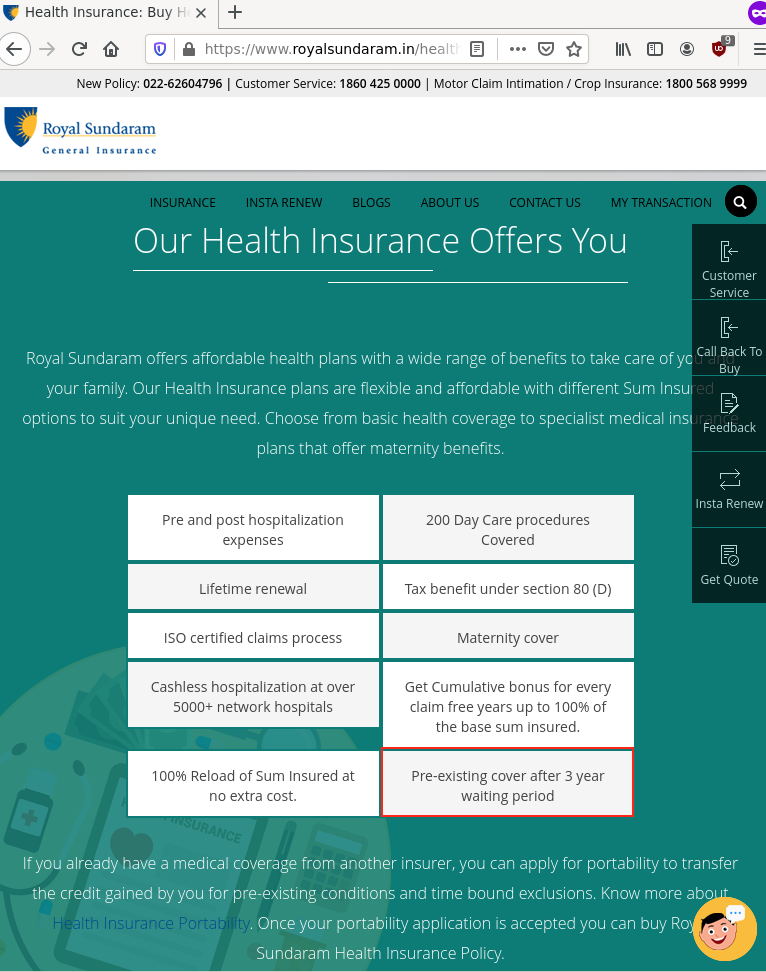

In spite of advertising waiting period for PEDs on their websites, I found out that these insurers are blatantly disregarding the IRDAI guidelines w.r.t PEDs even when they advertise 'waiting period' on their websites.

The following insurers denied me the insurance policy citing my preexisting illness, even after I pointed out the IRDAI guidelines and raised a complaint with IRDAI's grievances cell.

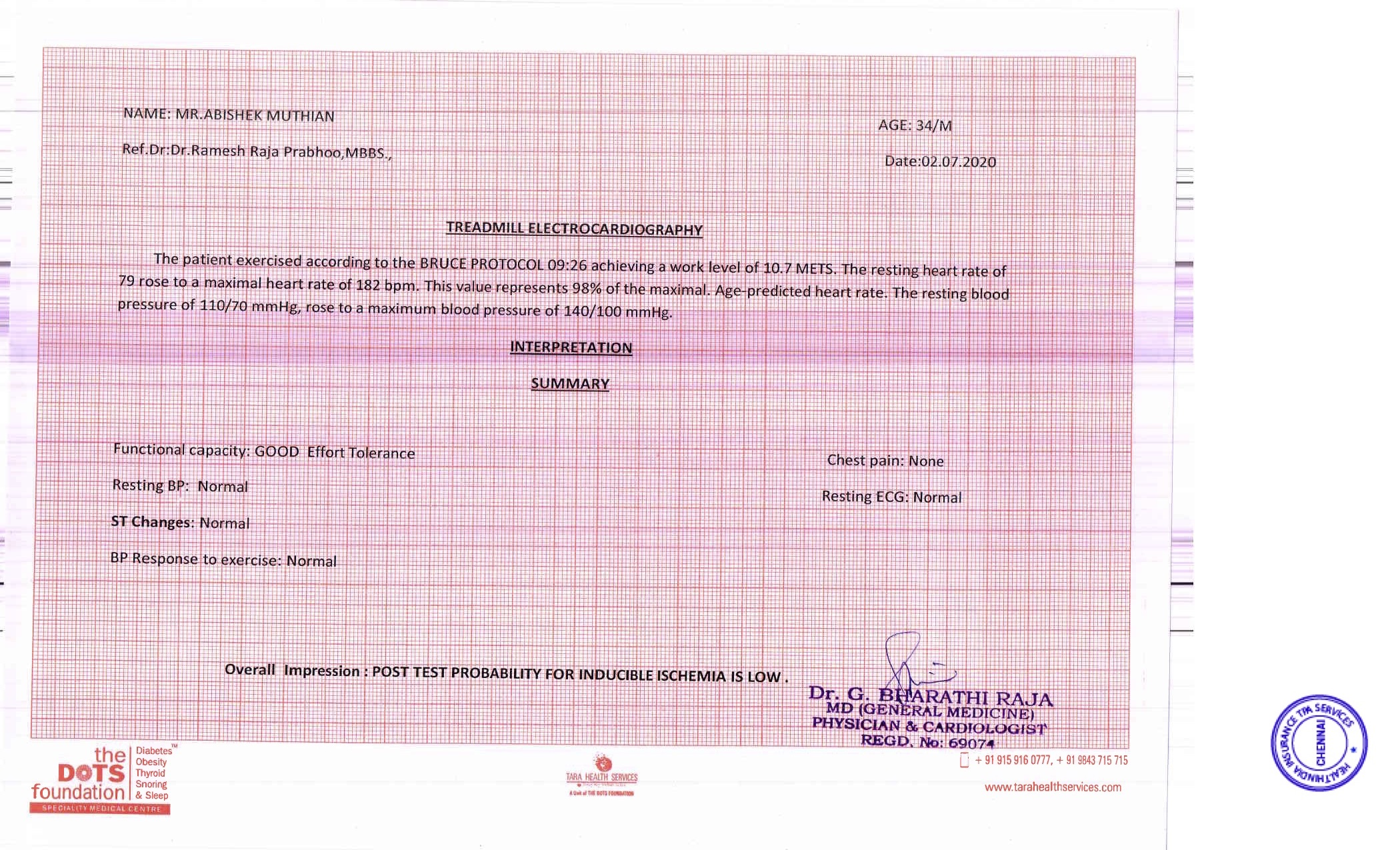

Some went took extraordinary measures to deny me the policy, even after conducting a thorough medical test in which their own doctor certified me as healthy for the policy. Some, didn't even bother to conduct an underwriter call and denied me the policy from my stated PEDs in the application after receiving the premium payment.

It is to be noted that, to the best of my knowledge the diseases I suffer from isn't even permanently excluded according to IRDAI's guidelines and even if it was the insurers are supposed to exclude it from coverage and provide me with the insurance policy.

Insurer behaviour towards preexisting diseases

Royal Sundaram General Insurance

After I applied for a health insurance quote on their website, Royal Sundaram's agent called me over phone. I told him about my health condition several times, I was told that I would be given a policy with waiting period and utmost I would be required to take a medical test to show my current health condition.

The agent ensured that I applied for the policy by calling me repeatedly until one day I finally applied for the policy through their website.

Note: The diseases I mention in the preexisting diseases column are what mentioned in my discharge summary of my 2018 surgery.

After couple of days I received a call from the underwriter doctor from Royal Sundaram, I explained clearly my sickness and answered specific Yes/No questions in the call. After the call, I remembered that I'm taking treatment for Osteoporosis (Yearly single zoledronic acid inject and monthly Vitamin D tablets); So, I called the doctor again and informed him about my osteoporosis treatment.

A day later I was told by another representative of Royal Sundaram that I have to undergo medical tests, which I promptly agreed. My only concern was that I have to travel, visit a hospital when there was increasing number of COVID-19 cases in my city.

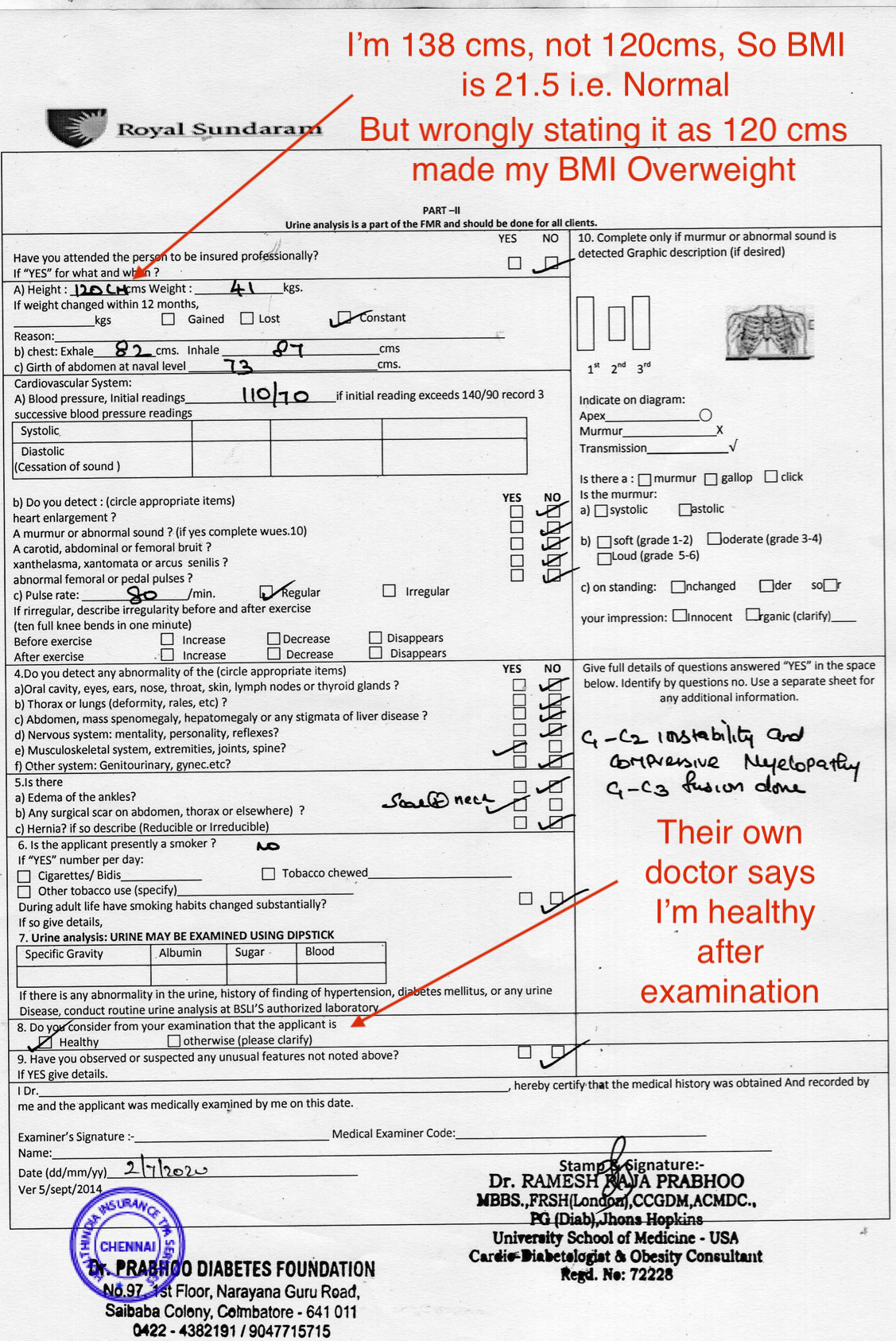

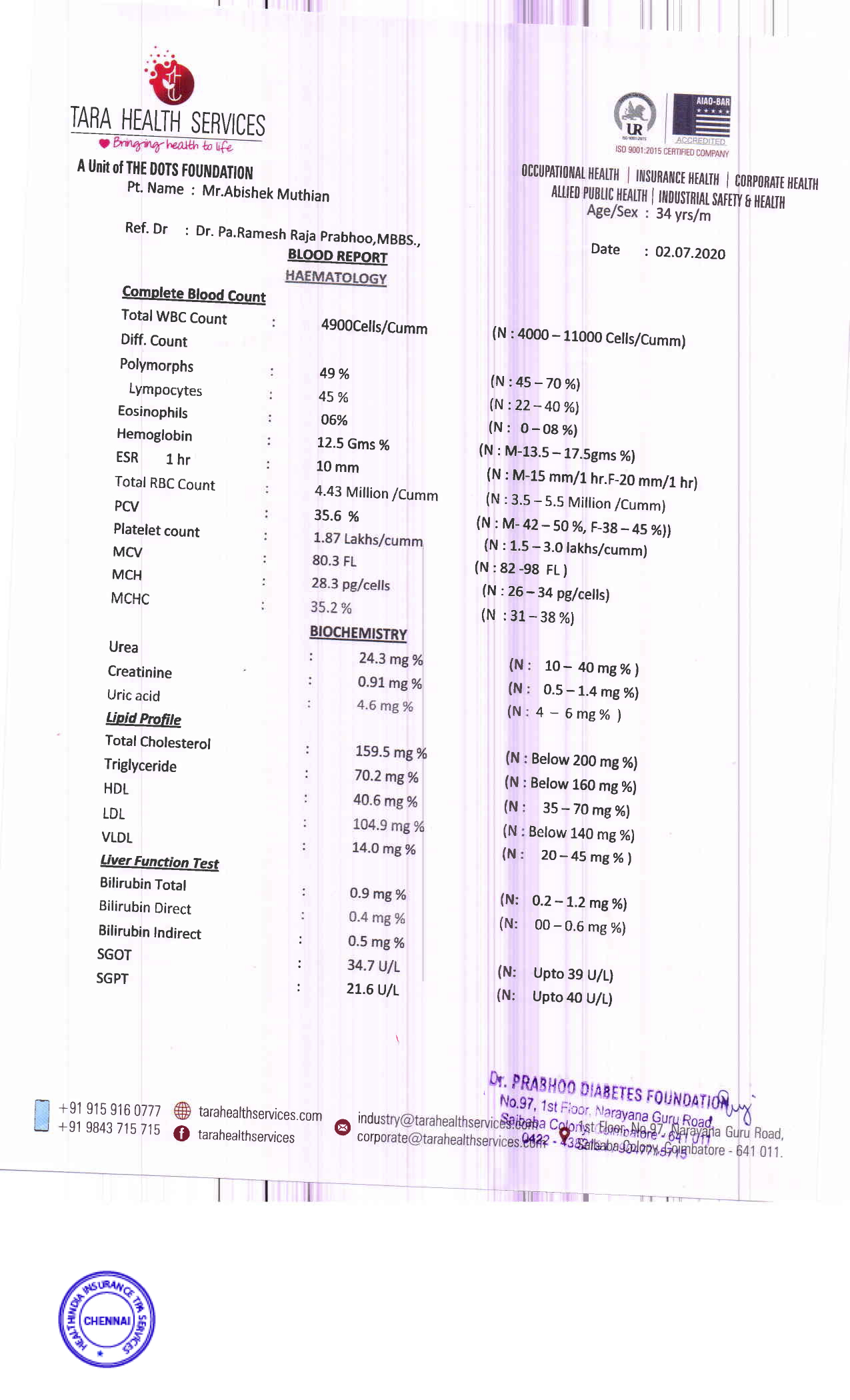

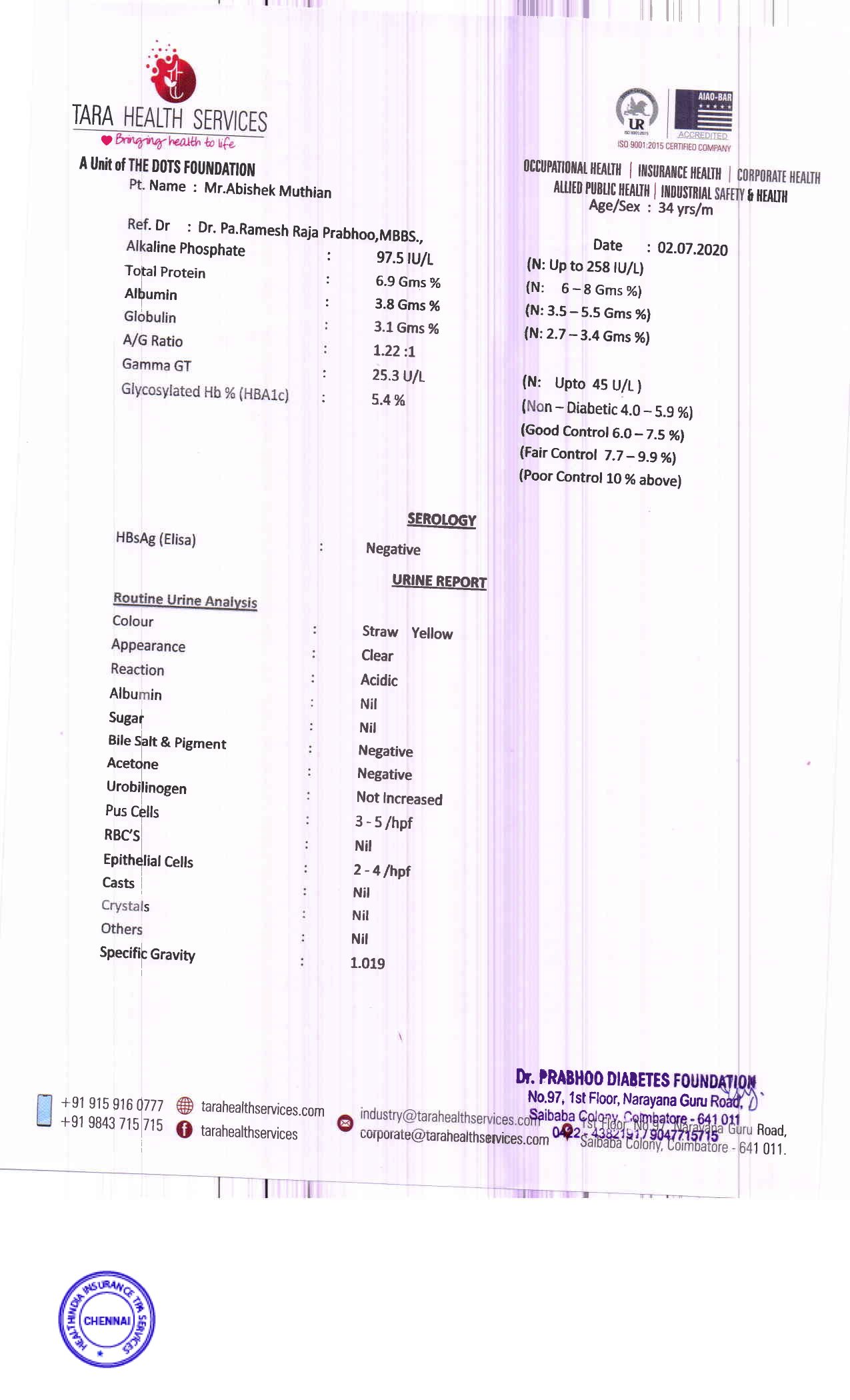

During the medical tests initiated by Royal Sundaram, I underwent -

- Blood Test

- Urine Test

- Thread Mill Test

- Examination by Doctor

During the examination by the doctor, I clearly explained my health history, I was asked to email the discharge summary of my surgery which I promptly did.

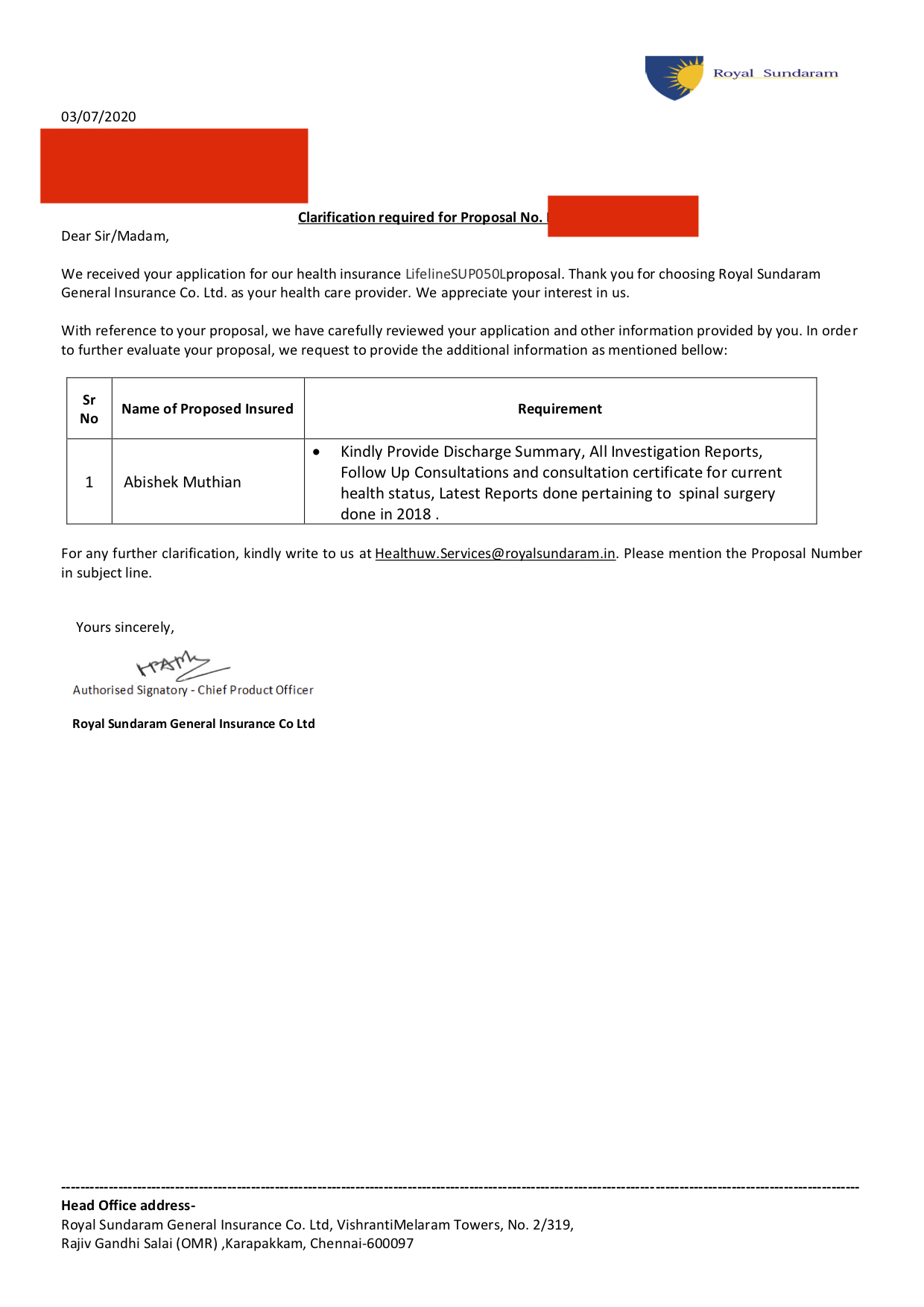

Few days later I received a mail from Royal Sundaram's medical team to submit my discharge summary, follow-up medical checkups regarding my surgery.

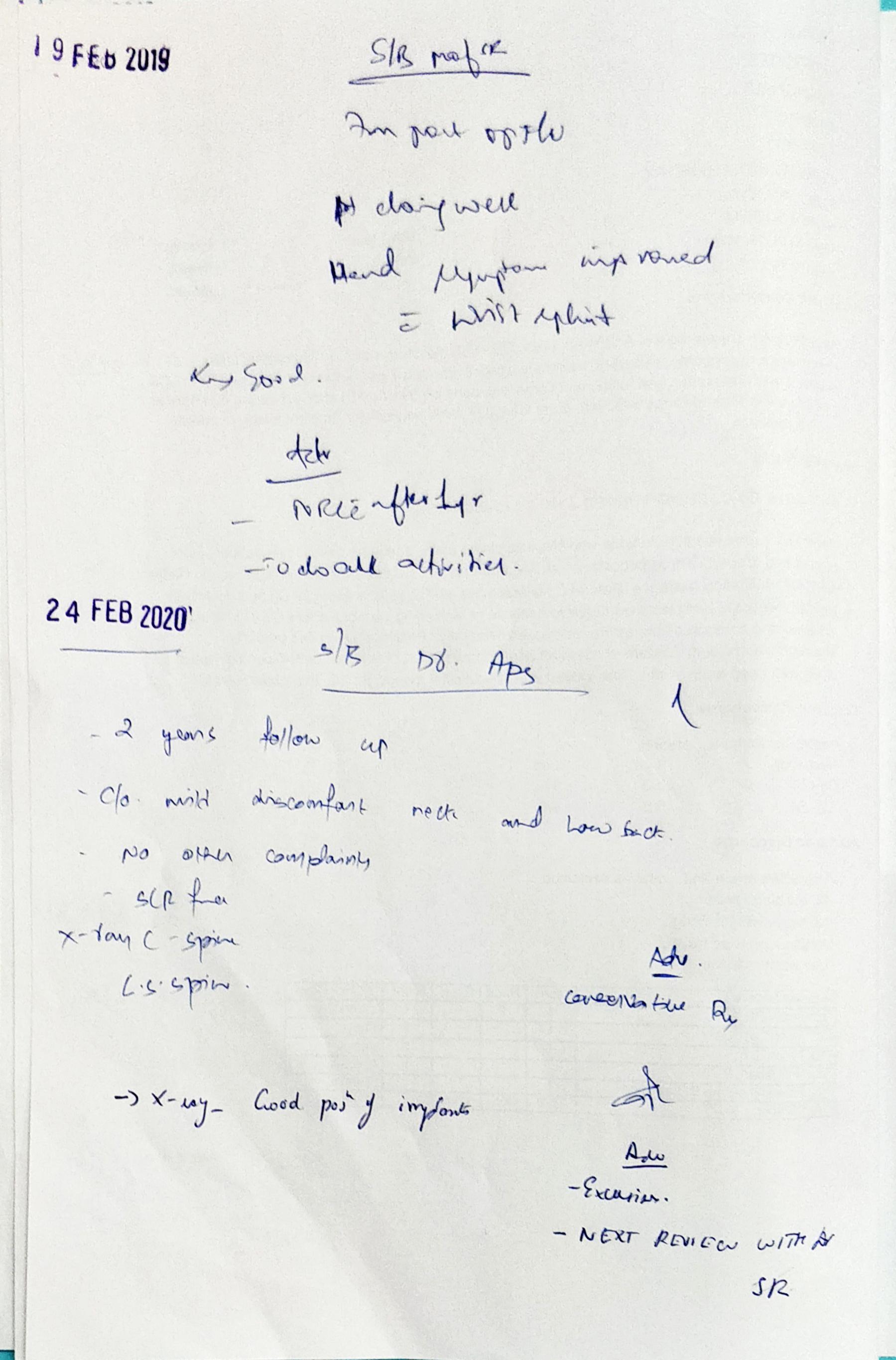

I promptly mailed them my discharge summary along with the latest follow-up report in which the doctor has mentioned that my implant status as good.

Note: I had also sent my discharge summary to the doctor who examined me at the hospital where the medical tests were conducted.

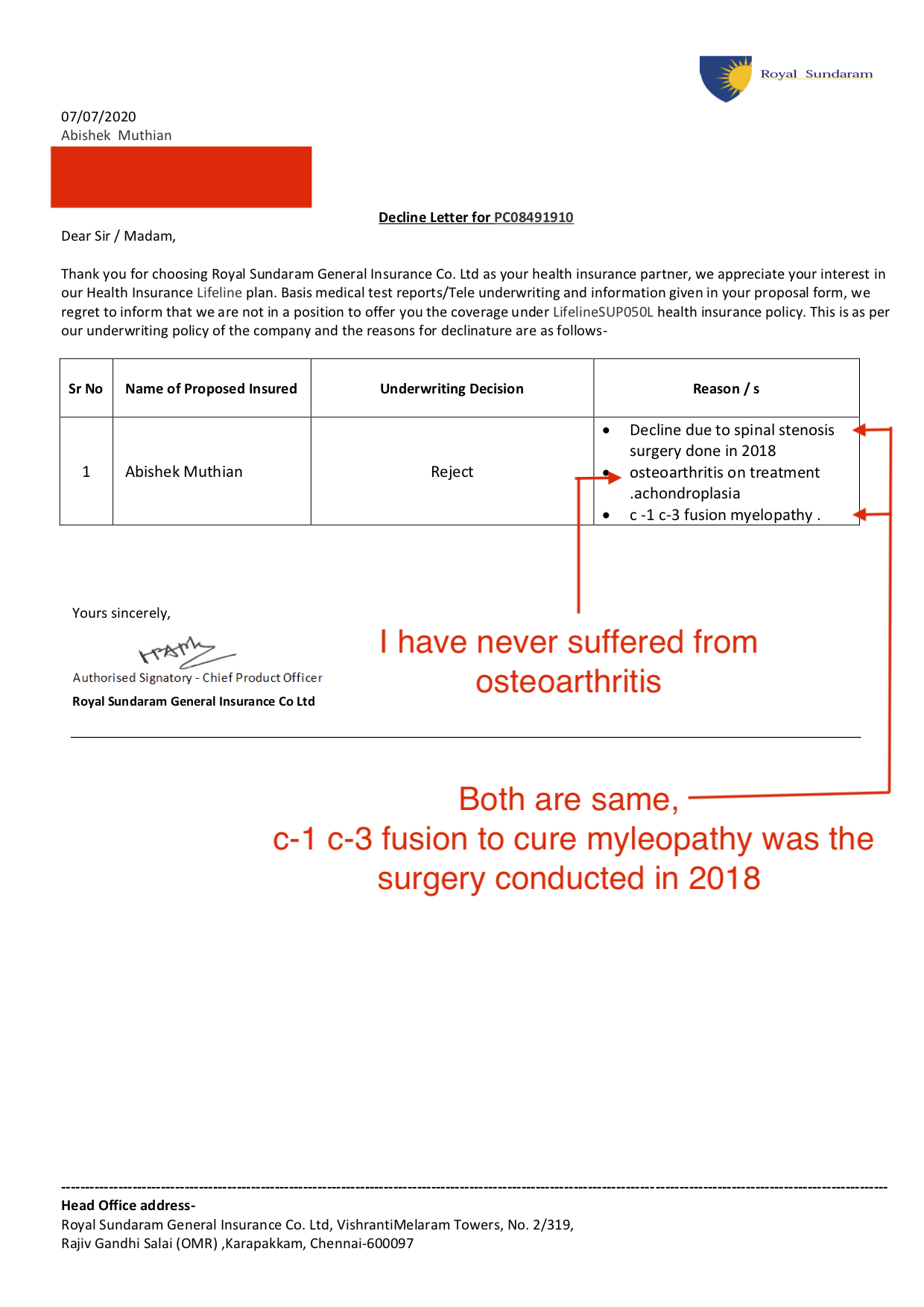

After couple of days, I was greeted with this letter in email from Royal Sundaram - (Markings in RED are mine)

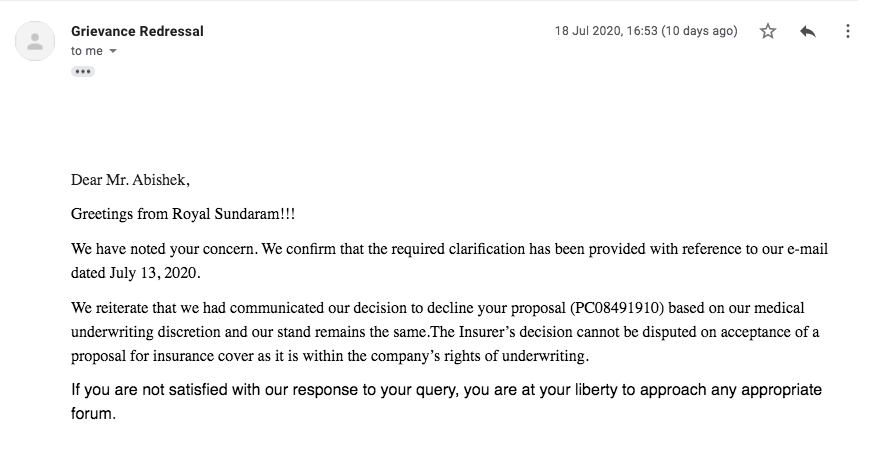

I requested them several times to follow the IRDAI guidelines in providing me a waiting period regarding preexisting disease and to remove the diseases I don't suffer from. They maintained that they have the right to reject my application and didn't use the term 'waiting period' in any of their communication to me after rejection of my insurance proposal.

I had no choice but to raise a complaint with IRDAI on Royal Sundaram through their grievances cell.

Through that complaint I requested Royal Sundaram for the following -

- To provide me a policy with waiting period(if necessary) in accordance with IRDAI's guidelines.

- Fix the misrepresentation of my diseases.

- Provide me with the medical report of the tests conducted by Royal Sundaram.

After escalation, numerous calls to the IRDAI's grievances cell, I was provided with the medical tests report from Royal Sundaram.(Markings in RED are mine)

Note: I noticed the wrong height mentioned in the medical test report only at the time writing this. So I didn't raise this in my conversations with Royal Sundaram team.

Royal Sundaram never specifically answered why they denied me the policy even after their own doctor certified me to be healthy, But they sent me a revised rejection letter correcting one of the wrong diseases.

.jpg)

Open questions regarding the revised rejection letter -

- Why are the same diseases duplicated with different terms, Is this intentional misrepresentation to increase the number of Reason/s?

- There is no cure for Achondroplasia, it is not a life threatening disease and it is not even part of permanent exclusion of coverage according to IRDAI's guidelines on exclusions.

In spite of repeatedly asking these questions through IRDAI's grievances cell, Royal Sundaram's grievances team sent me the same reply referring me to the revised rejection letter.

IRDAI grievances cell has told me that, there's nothing else they can do about this, they asked me to take Royal Sundaram Insurance to the court mentioning this complaint token number, in spite of repeatedly agreeing to me over the calls that the Insurer is obliged to provide me a with an insurance policy with appropriate waiting period.

ICICI Lombard General Insurance

The events with ICICI Lombard cannot be told without the huge payment related hassle I had with it.

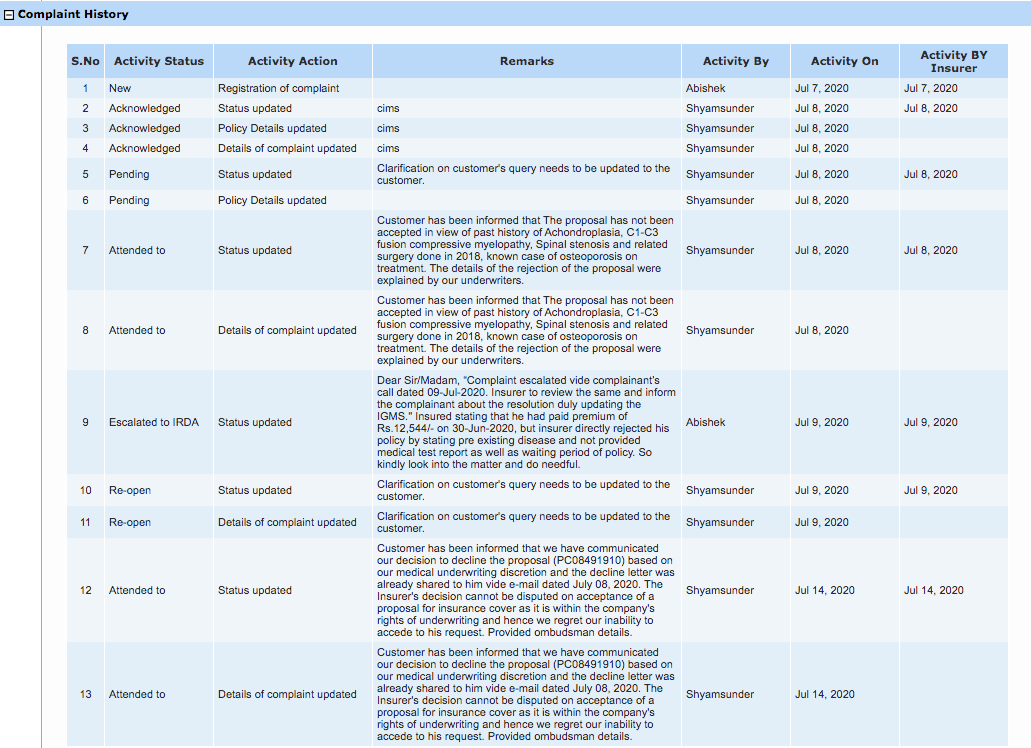

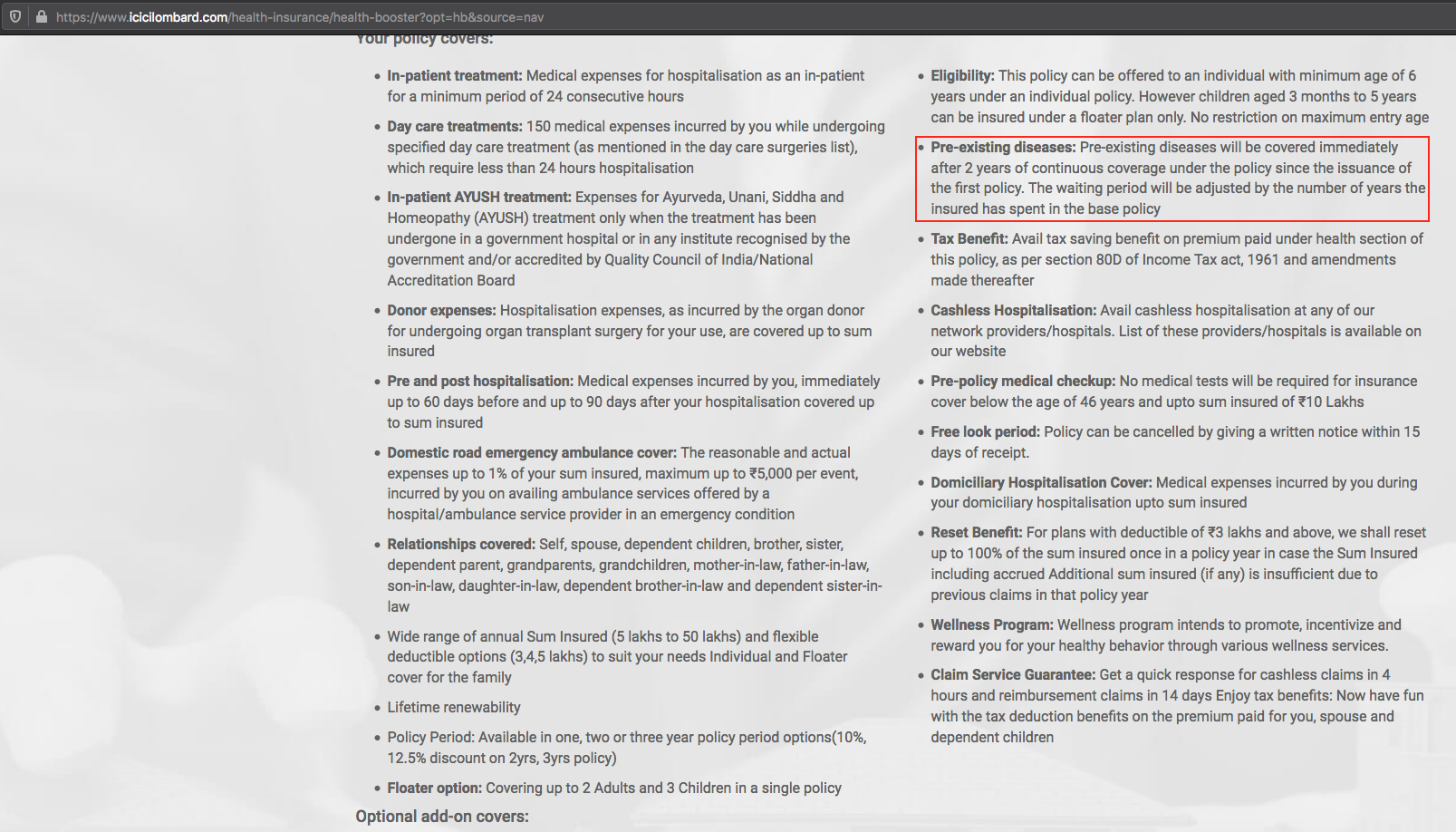

But first, lets see what it says about preexisting illness on its website -

Of course it claims to cover preexisting illness after the waiting period of 2 years, not only that it has loads of articles on preexisting illness like this with the header 'Avail Health Insurance even with Pre-Existing Condition'.

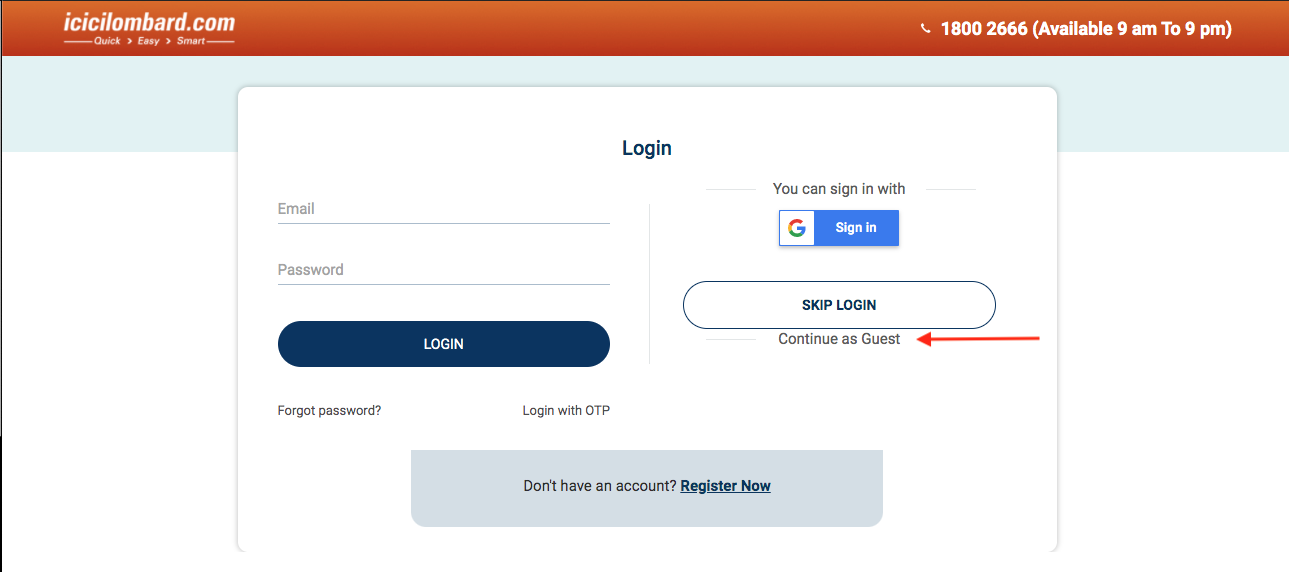

I applied for the health booster top-up insurance policy on the ICICI Lombard website after declaring my preexisting illness and made my payment through their 'Guest' login option.

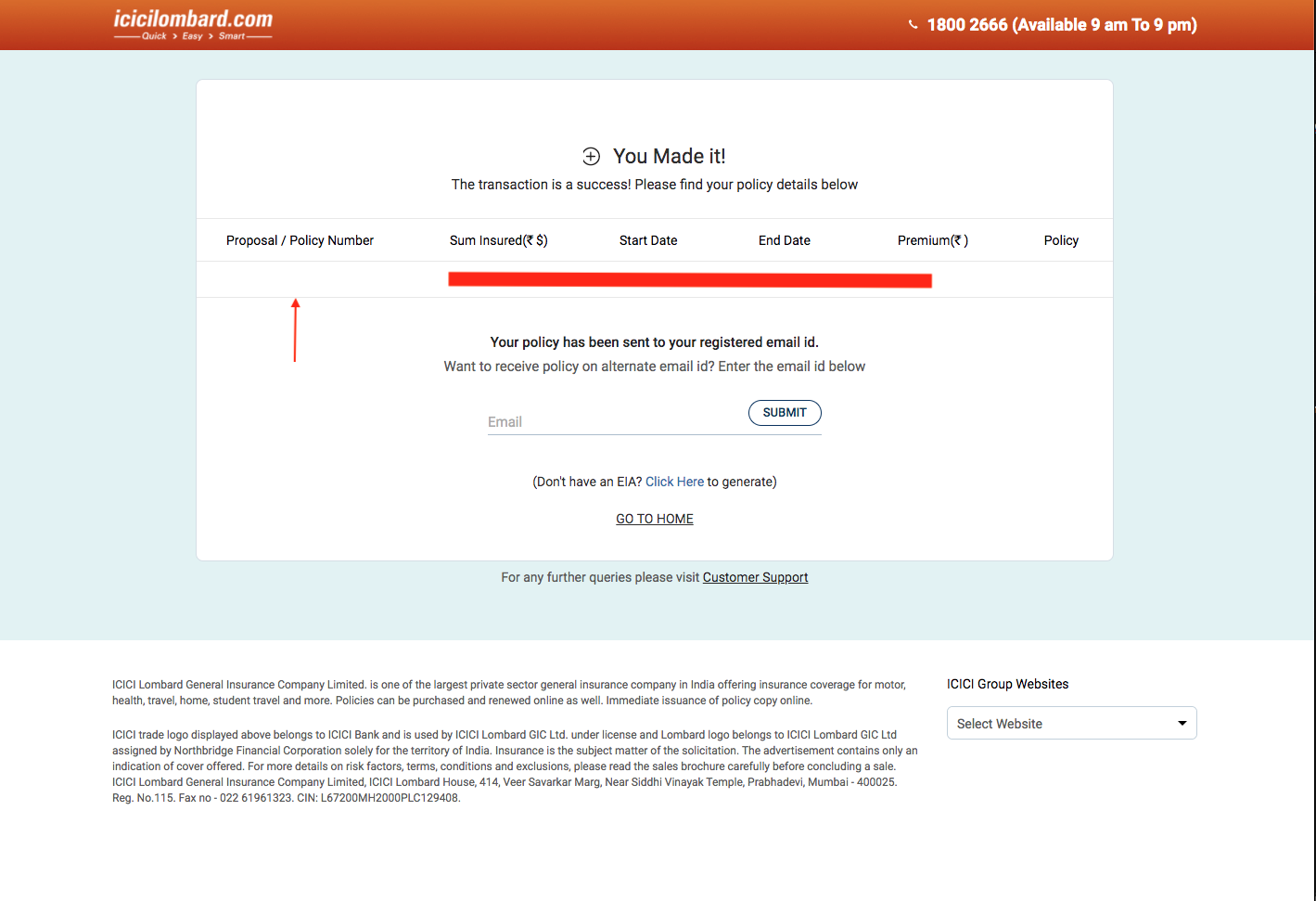

No policy proposal number was generated after the payment.

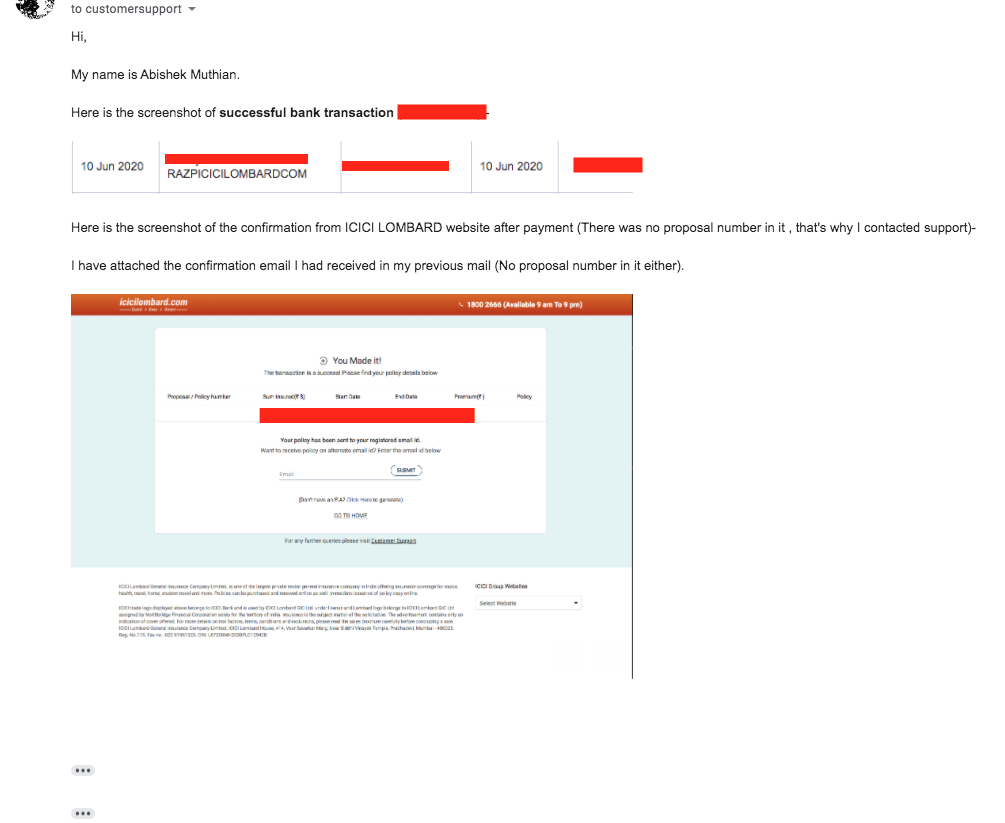

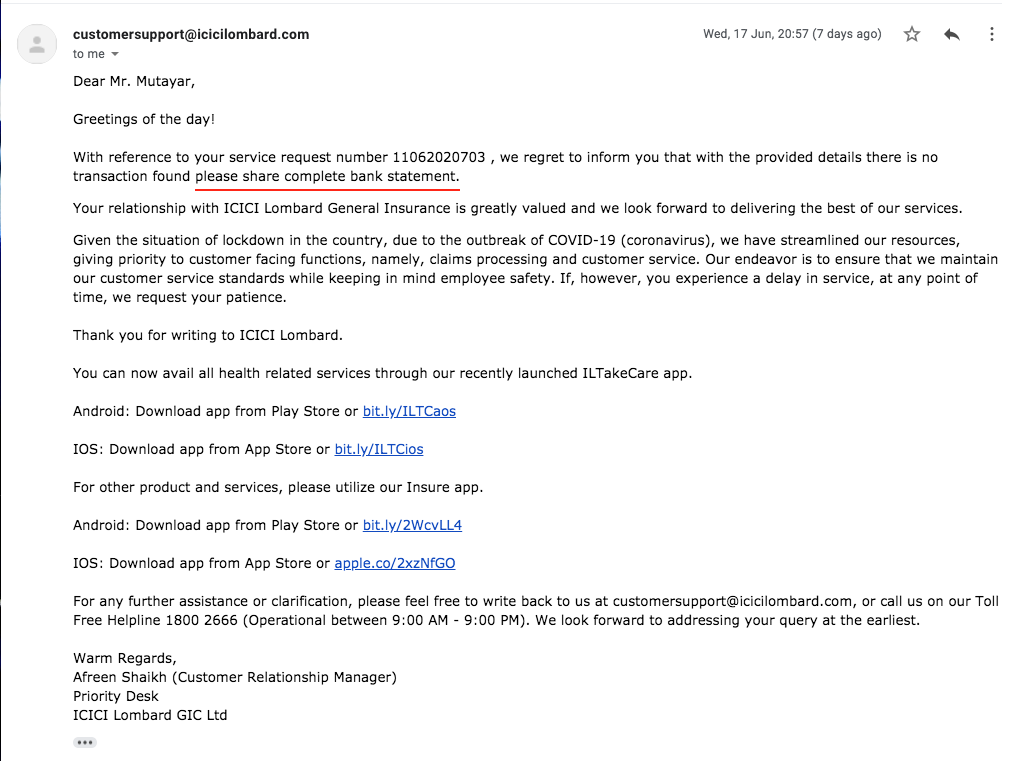

I wrote to the customer support of ICICI Lombard attaching the email I received from them after payment, asking why no proposal number was generated for my policy.

After several calls and emails they told me that they were unable to find my payment and asked me to send the bank transaction details, which I did.

After couple of days, they wanted my complete bank statement!

I asked them, why they needed my complete bank statement in spite of sharing the required transaction details. As I received no reply, I sent my complete bank statement as well. But ICICI customer support stopped replying to me.

In the midst of this I received an underwriter call from ICICI Lombard, who quickly wrapped up the call once I said about my surgery. I specifically asked about my proposal number during that call, "I was told, I would receive a SMS".

Still the payment issue was not resolved, Since I received no reply for days, I started tweeting about this payment fiasco on Twitter tagging ICICI Lombard and I got reached out by their escalation team. I received a call from the escalation team, who promised that their customer support would reach out to me.

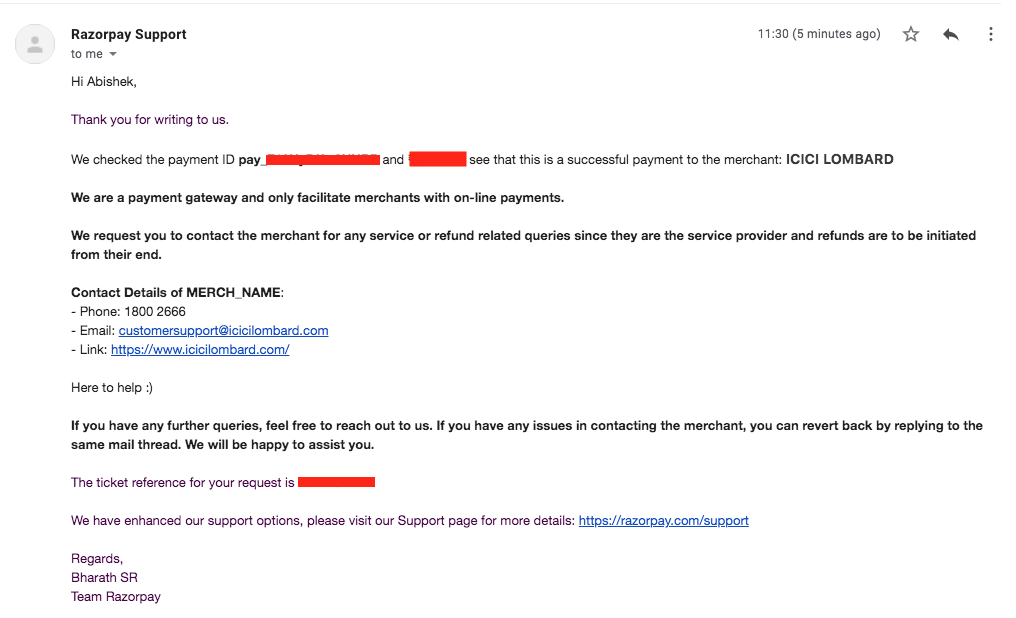

Meanwhile, I reached out to Razorpay - the payment gateway used by ICICI Lombard to process my online payment and received confirmation that my payment was successful. Which I sent to ICICI Lombard, yet I didn't receive any reply from ICICI Lombard even after doing their job for them.

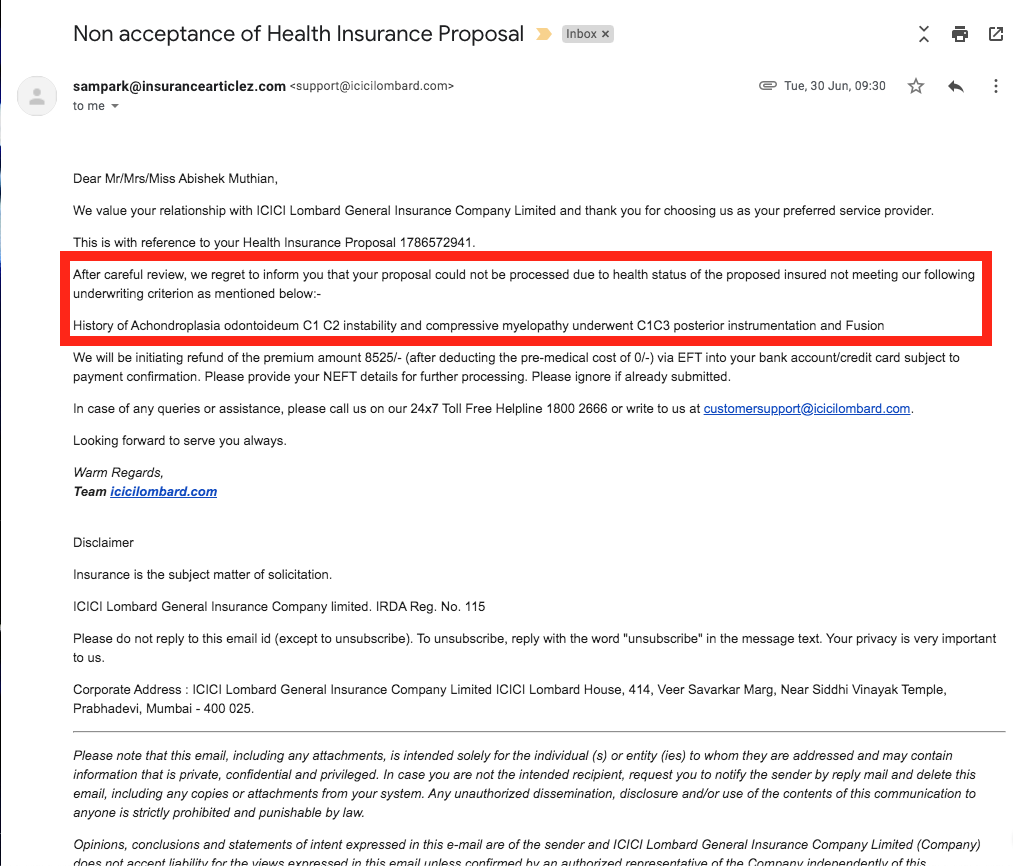

Since, ICICI Lombard customer support stopped replying to me(since I sent the bank statement), I had no other choice but to raise the complaint with IRDAI's grievances cell via email with CC to ICICI Lombard customer support. Sure enough ICICI Lombard's service quality team reached out to me and asked for the discharge summary of my surgery. I sent them the discharge summary for the surgery.

Note: This is the first time ICICI Lombard is asking for my discharge summary. My proposal number for the policy and payment confirmation was given after specifically asking for it again to the service quality team.

After couple of days, I received this -

My requests, asking them to adhere to the IRDAI's guidelines regarding preexisting was not accepted. I had to update my IRDAI complaint now mentioning that ICICI Lombard has denied me the policy citing preexisting illness against IRDAI's guidelines.

Weeks went by without any information from ICICI Lombard on why they are not providing me a policy with waiting period, nor was I provided the refund for my payment. I had to deal with denial of policy via IRDAI grievances cell and not receiving payment refund with ICICI Lombard's priority support team which takes hours to reach over a call.

The refund for payment was received weeks after denying me my policy and dozens of calls; yet ICICI Lombard didn't answer why they denied me the policy against IRDAI's guidelines.

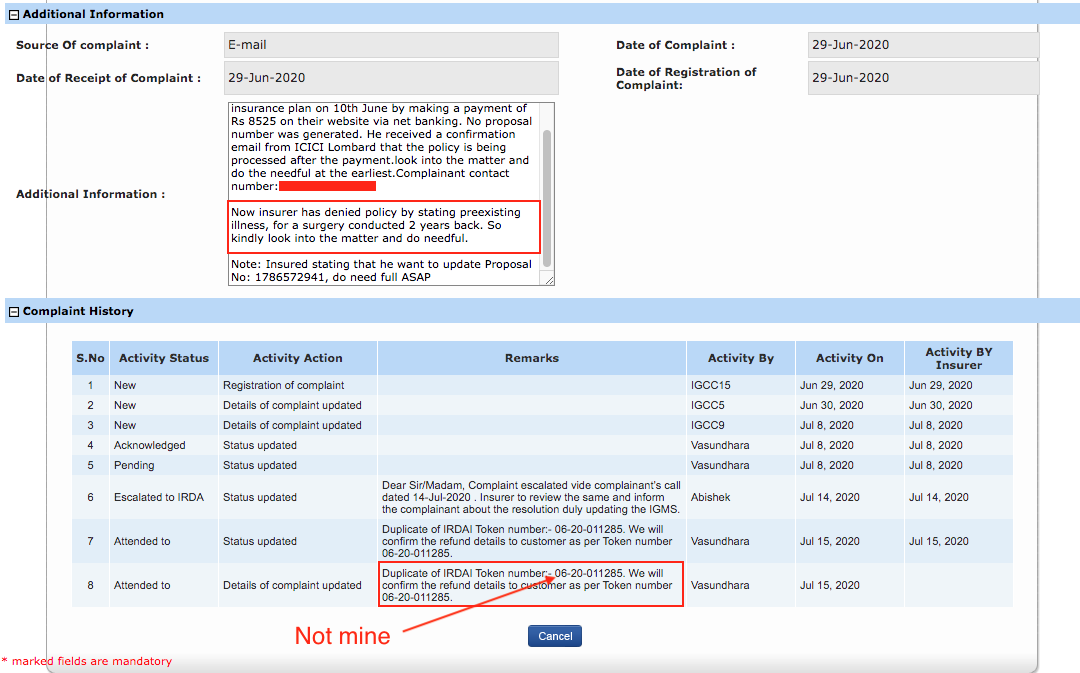

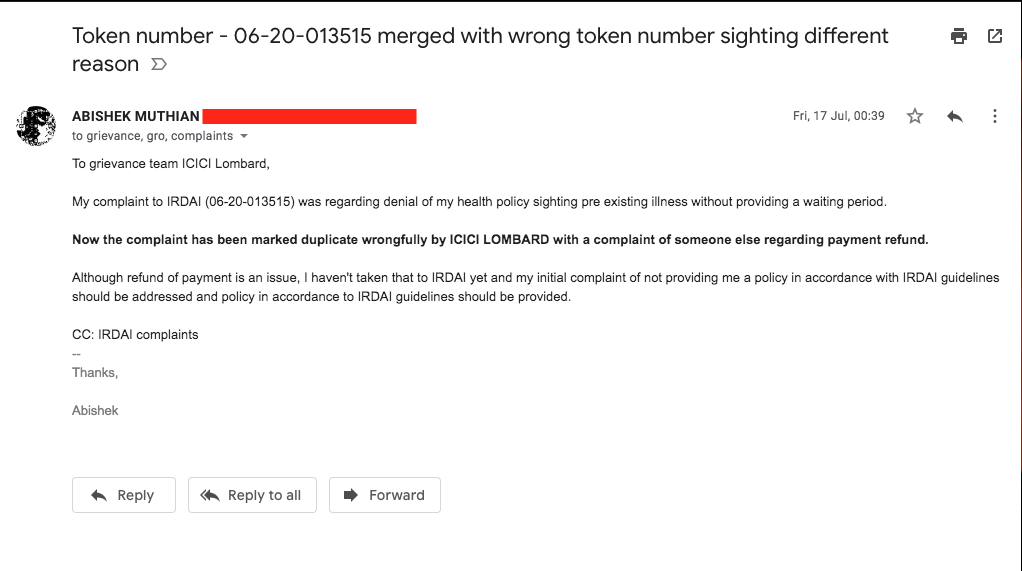

ICICI Lombard marked my IRDAI grievances cell complaint as duplicate with someone else's payment issue and marked it as being 'Attended to'.

I tried my best to explain to IRDAI grievances cell that ICICI Lombard has wrongly marked my complaint as duplicate and the actual issue is not payment refund but denial of my policy, but they didn't do anything (more on that in a separate section detailing my ordeal with IRDAI's grievances cell below).

I even sent them an email telling they have marked my complaint as duplicate wrongfully, they didn't reply.

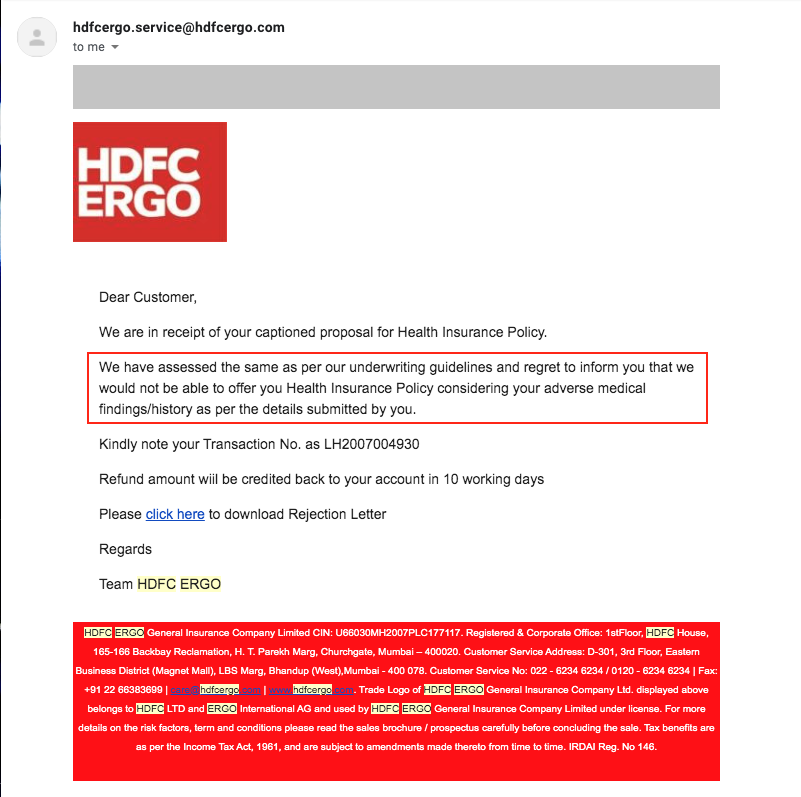

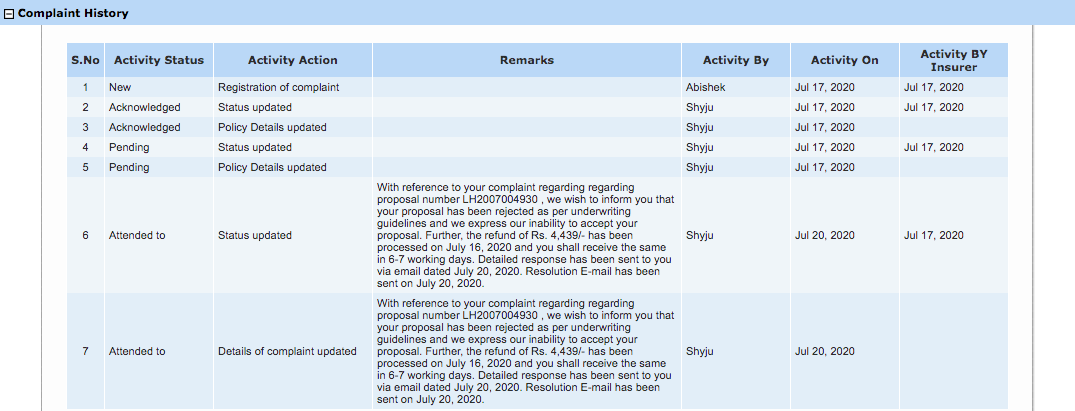

HDFC ERGO

HDFC ERGO is my current base plan insurer. I subscribed to this plan 5 years back, 3 years before the spine surgery. When I had applied to that policy, I had properly disclosed the medical surgeries I had during my childhood even though IRDAI guidelines specifically says that the preexisting disease as something which was diagnosed 48 months prior to the application.

Every month or so I would receive a call from their HDFC ERGO agent which goes like this -

- Since I'm a valuable customer, I have received a special offer for a health policy top-up plan which would increase my coverage (~ 5x times).

- I would be always told 'Today is the last date to apply'.

- When I agree to the top-up plan, their underwriter would take over the call.

- This is when I disclose my 2018 surgery and that I had taken a claim for that.

- After a moment of awkward silence, I would be told that that they cannot provide me a policy.

This has happened so many times that I have lost count of it. Latest of such call was in july when already I was fighting with the above said insurers for my rights.

Take a listen -

Download the .mp3 file directly if you have trouble playing the audio

Obviously, the agent did not call me back again. So, I called him and he told me that 'Since I wanted to check other COVID-19 specific policies he didn't call back', of course it was false. After I confronted him about the false statements, he said 'No policies are given for accident cases' for which I told him I never had any accident. In the end, he told me 'His superiors denied me a policy because I had suffered a surgery and taken a claim'.

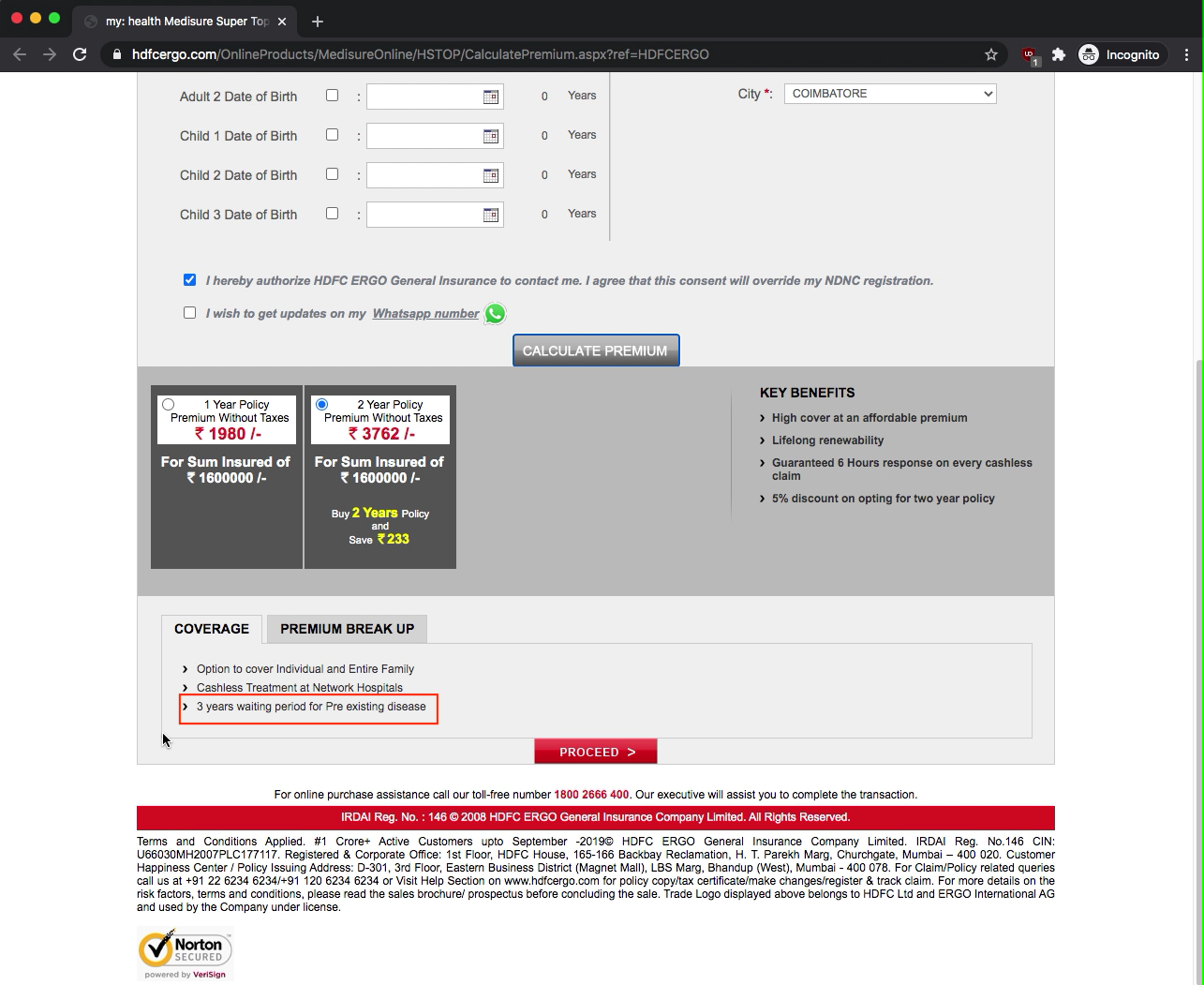

Before I make a complaint about HDFC ERGO to IRDAI, I wanted to check if the experience when applied from their website is any different.

HDFC ERGO claims to provide policies for those with preexisting illness -

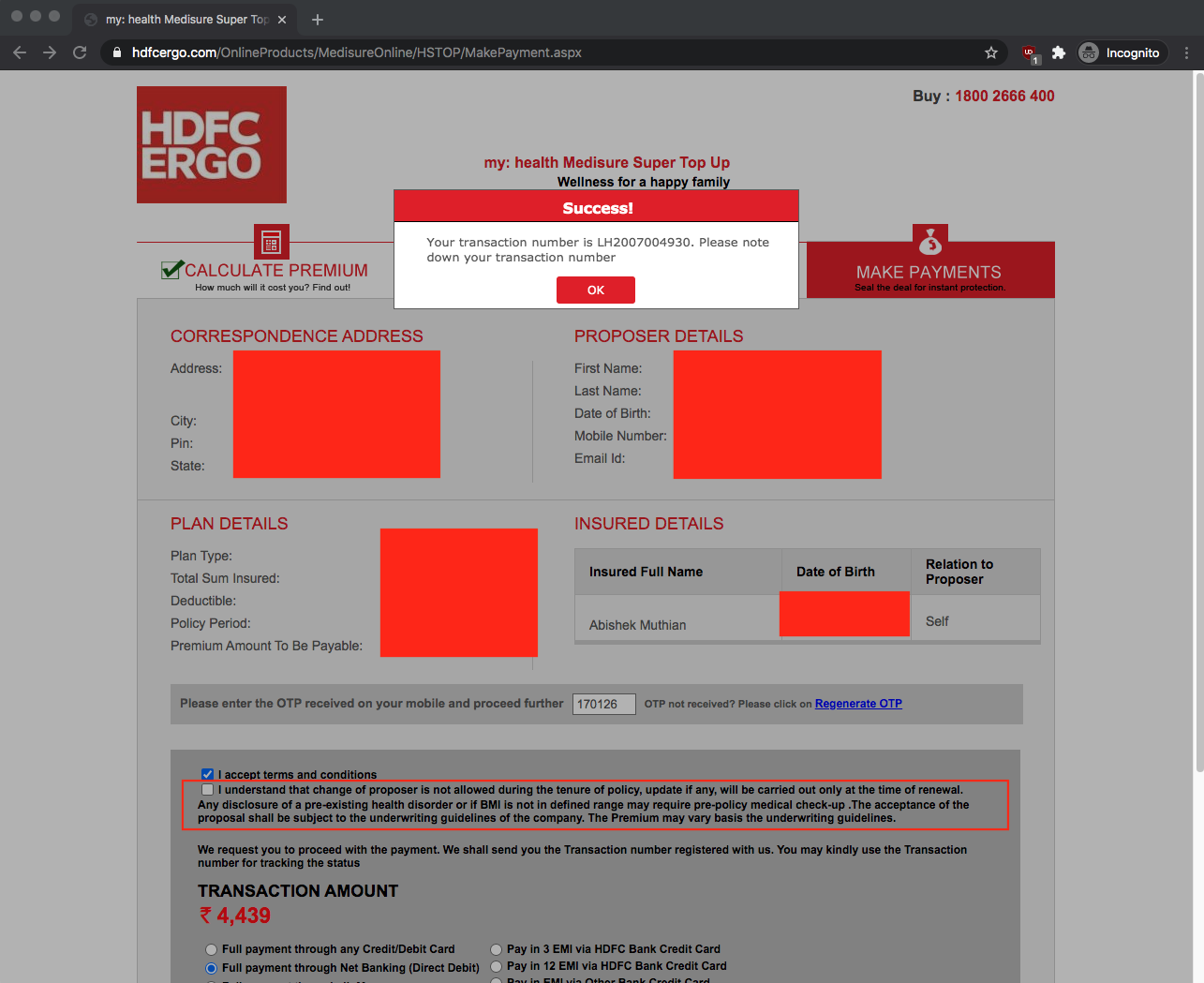

HDFC ERGO application has specific condition regarding preexisting illness near the terms and conditions, but it's not mandatory to accept. I'm not sure whether it's not mandatory due to IRDAI's guidelines, but I didn't accept it in my application.

Within next couple of hours, I received this rejection from HDFC ERGO -

So, there is not even an underwriter call before rejection when applying for insurance at HDFC ERGO through their website. If the policy is going to be denied for those with preexisting illness automatically, then why make us go through the hassle of applying and making the payment?

I raised an issue with IRDAI's grievances cell regarding HDFC ERGO's denial of insurance policy citing preexisting illness against IRDAI's guidelines.

HDFC ERGO marked the complaint as 'Attended To' citing the previous rejection letter.

Did you notice how the insurers are conveniently omitting the term 'preexisting illness', 'waiting period' in their response to IRDAI complaint in spite of me specifically raising that as the complaint?

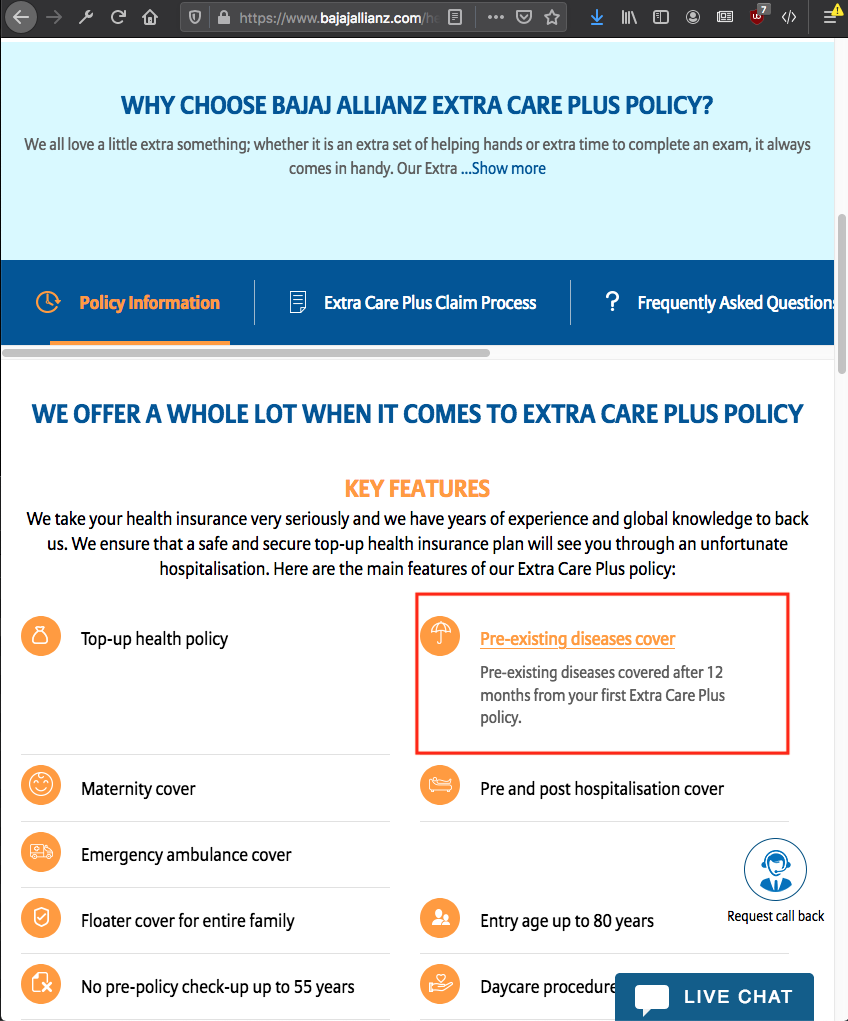

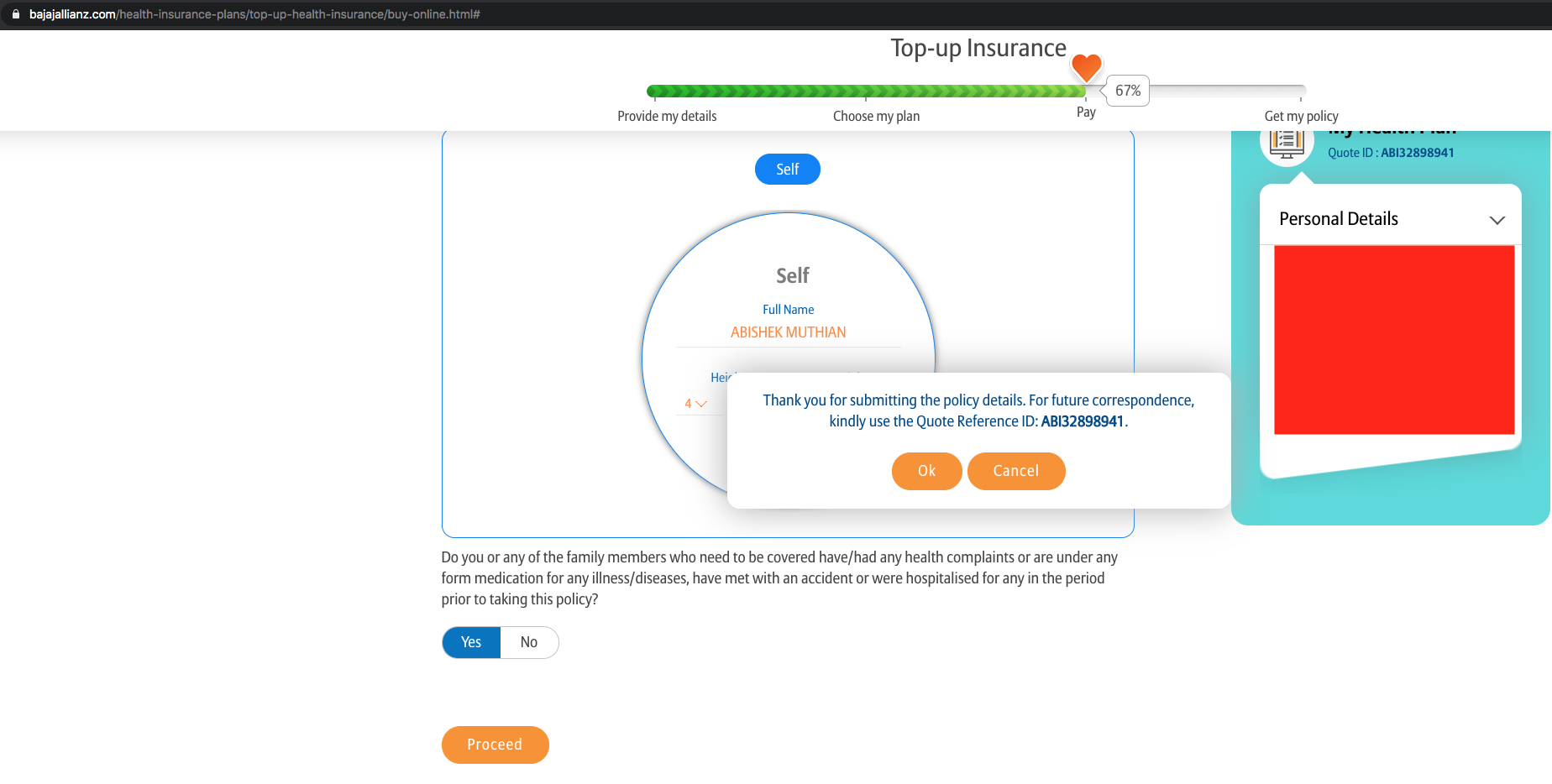

Bajaj Allianz

Bajaj Allianz claims 12 months waiting period for the coverage of preexisting diseases.

Application for Bajaj Allianz top-up health insurance only has a toggle for declaring preexisting illness which I selected. Unlike previous insurers, Bajaj Allianz doesn't mandate a payment for application(perhaps because I selected preexisting illness).

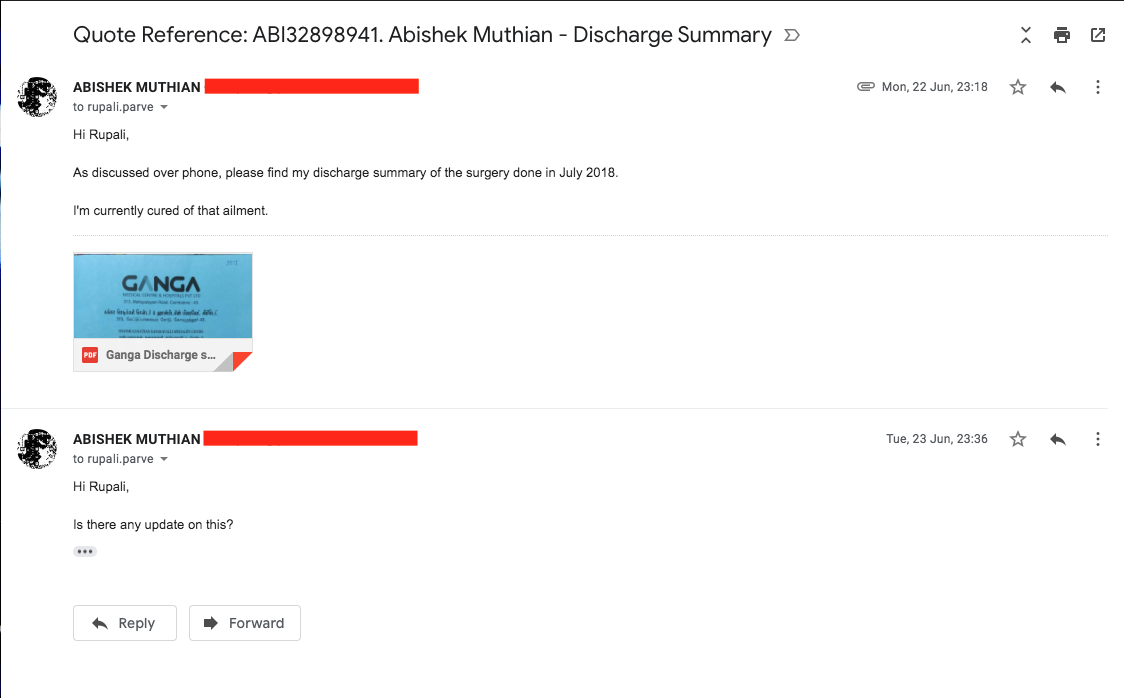

The next day, I received a call from Bajaj Allianz's underwriter in which I told her about my surgery, She wrapped up the call quickly and asked me to email her my discharge summary.

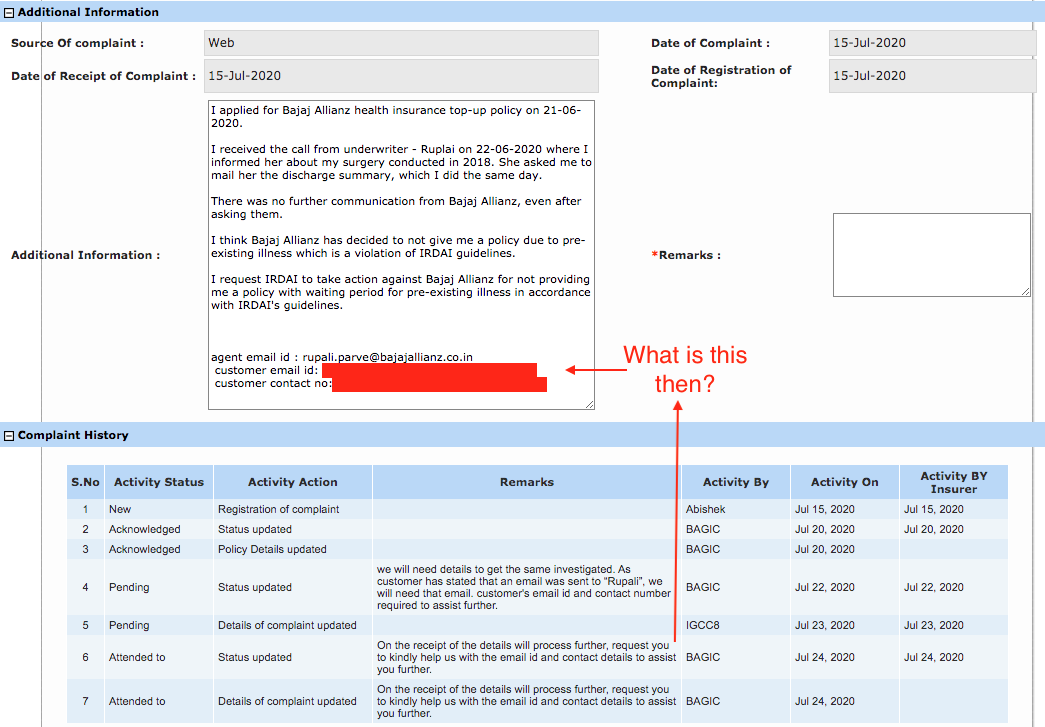

Till date, I did not hear back from Bajaj Allianz even after raising a complaint to IRDAI grievances cell.

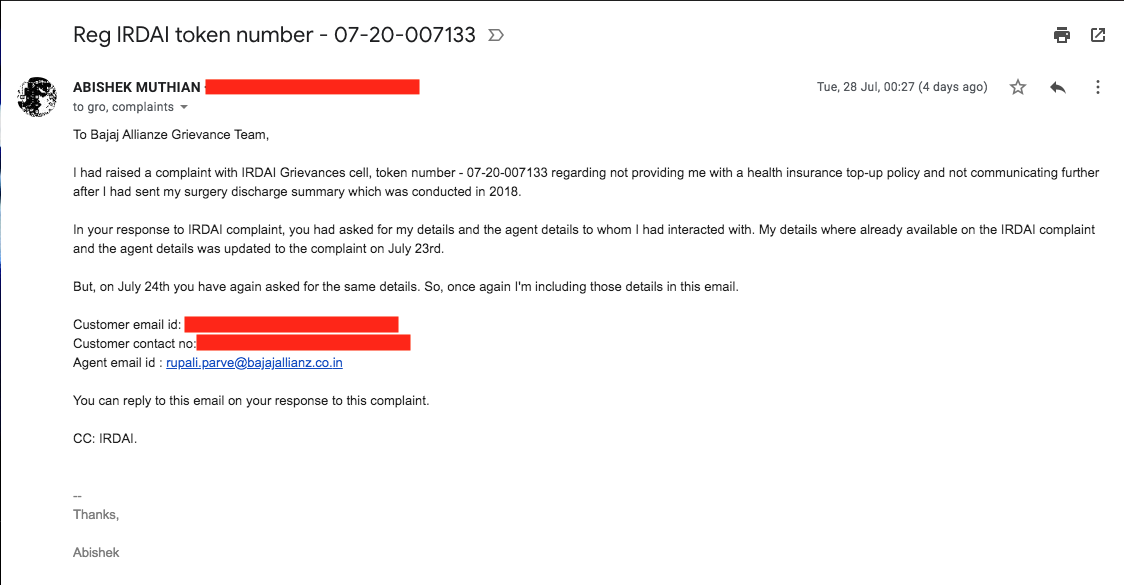

In spite of clearly mentioning the details in my complaint to IRDAI, Bajaj Allianz team marked the complaint 'Attended to' pending receipt of the details to process further.

Since they are not acknowledging the availability of required information on the IRDAI complaint, I mailed their grievances department directly.

I did not receive any reply for that.

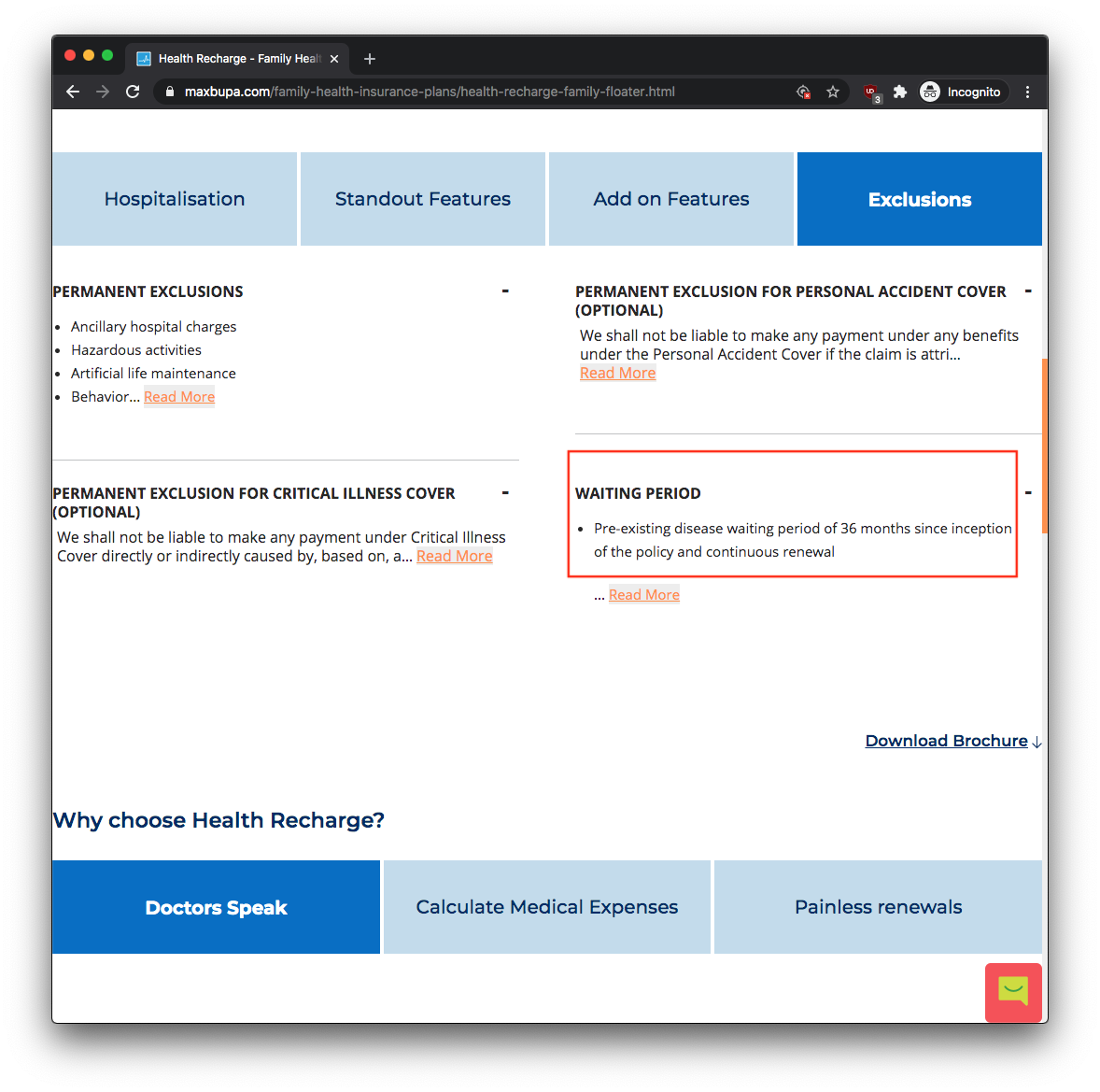

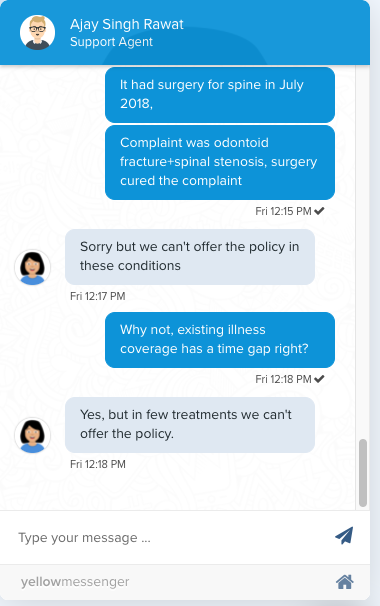

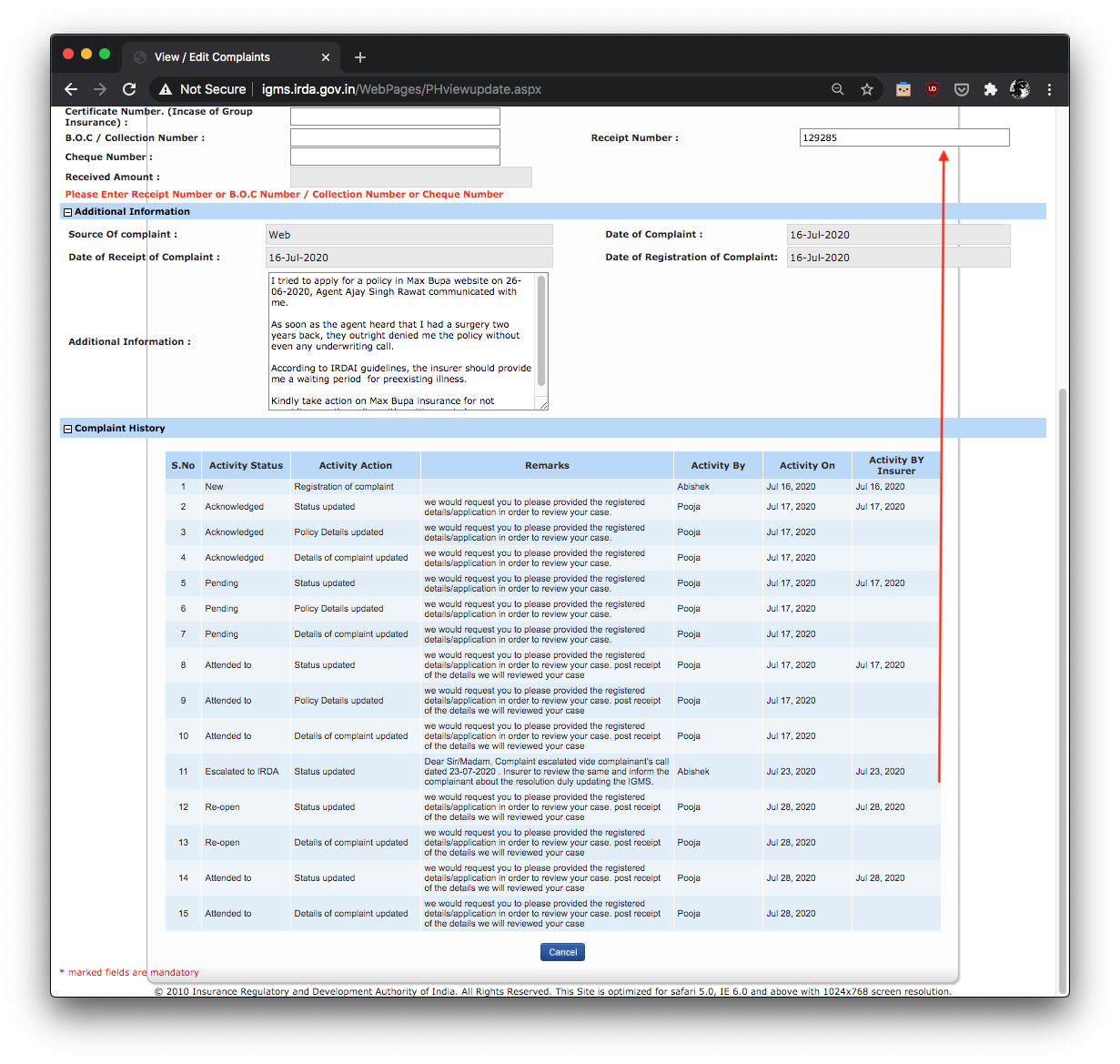

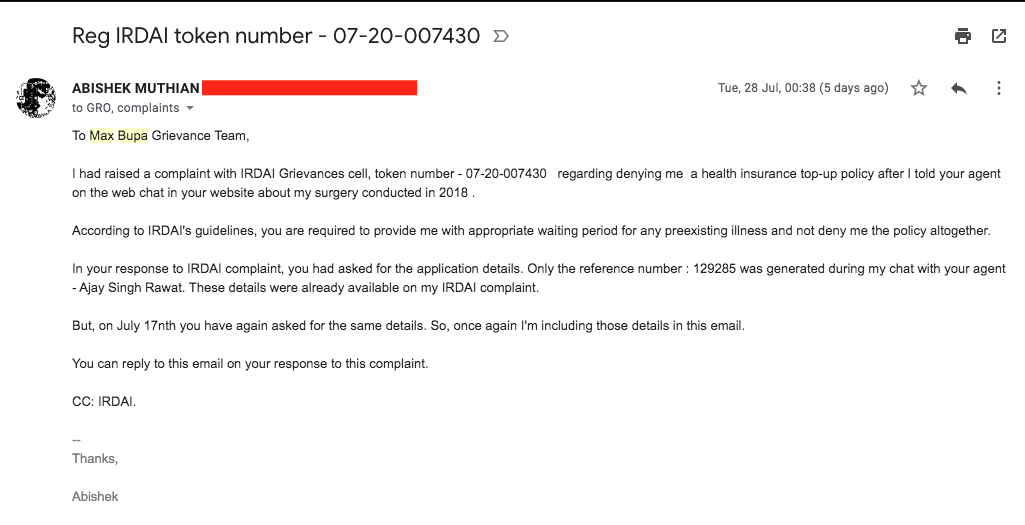

Max Bupa

Max Bupa website explicitly details exclusions for coverage, including permanent exclusions and waiting period.

Note: Exclusions mean non-coverage of illness and not denying the policy according to IRDAI's guidelines.

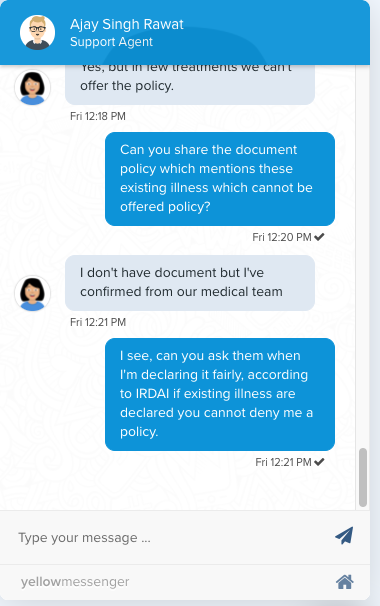

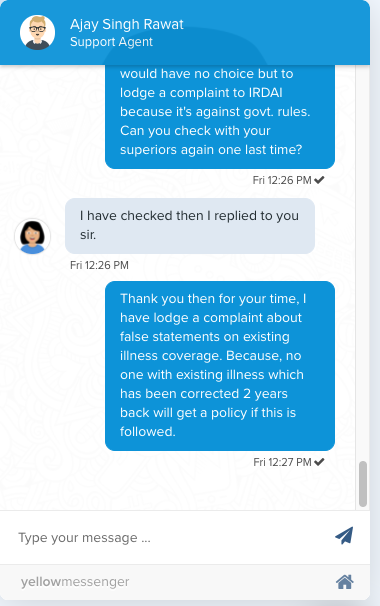

Chatting with their agent on their website is the first step for applying to their policy. But, their agent denied me even the opportunity to apply after I informed of my preexisting illness.

And I did raise a complaint with IRDAI's grievances cell.

As with complaints on other insurers, Max Bupa just marked it as 'Attended to' asking for 'registered details/application' when the receipt number which I received during my web chat with their agent was clearly mentioned in my complaint.

I even sent an email to Max Bupa insurance's grievances officer directly, as I did with other insurers.

I did not receive any reply for that.

IRDAI Grievances Cell

IRDAI's grievances cell is limited to arranging communication between Insurer and Insured. Although an Insurance Ombudsman exists, they say that it is applicable only to claim related issues and not proposal related complaints.

Furthermore, IRDAI's grievances cell seems to be favouring Insurers and they wave their hands once the Insurer has marked the complaint 'Attended to' even if the statement from their end is absolutely false and when my complaint was not resolved.

Case in point (1) -

I explained several times to the IRDAI grievances cell's agent that ICICI Lombard has wrongly marked my issue as duplicate and that my complaint to IRDAI was regarding policy for preexisting illness. The agent just repeated what the insurer had written and cuts me off abruptly.

Take a listen -

Download the .mp3 file directly if you have trouble playing the audio

Download the .mp3 file directly if you have trouble playing the audio

Case in point (2) -

As soon as the IRDAI's agent finds out that Max Bupa has marked the complaint 'Attended To', the agent cuts off the call pretending to not hear me.

Take a listen -

Download the .mp3 file directly if you have trouble playing the audio

Case in point (3) -

Another agent asked me to call back again after 15 days(their TAKT time) in spite of the Insurer - Max Bupa already having responded to complaint by asking for the application details.

I requested the agent to point the insurer to the mentioned reference number and update the complaint stating the same; In spite of repeatedly promising me that the given information would be updated in the complaint, the IRDAI grievances cell agent did not do it.

Take a listen -

Download the .mp3 file directly if you have trouble playing the audio

There are are plenty of other examples with me as I have made more than two dozen calls to IRDAI grievances cell regarding my complaints on these insurers.

Very rarely, the call gets to an IRDAI grievances cell agent who is bit more accommodating and offers detailed advice; Such as the one who told me that after the insurer has responded to the complaint(even with irrelevant information), I have no other option but to take them to the court mentioning the IRDAI complaint number.

What next?

I've spent hundreds of hours communicating with these insurers and IRDAI grievances cell in asking them to adhere to the IRDAI's guidelines on preexisting illness in vain, now I have no choice but to take them to the courts.

Not just because I might need the insurance to survive a COVID-19 infection or future ailments, Not just because these insurers have caused huge amount of emotional distress, but because now I have a moral responsibility to serve as a voice for those sick and disabled people who have been denied their right by these insurers.

All my life I have subscribed to the lie that, even if we are disabled, with our hard-work and preseverance we can compensate our disability to live a fruitful life. In spite of living my life as such, helping many others attain better quality of life through my work, I'm often faced with situations like these where my right to quality of life is denied from the onset.

At least I'm able to put my voice out in the public domain, think about those for whom exercising their fundamental right is a privilege and have been made to sit in a corner because they are sick or disabled. This often makes me question the value of life.

I think if the right to quality of life is going to be denied at every step we take, at least the right to not live should be enabled. Indian government might soon pass the long awaited euthanasia legislation. If the rights for sick and disabled are not going to be provided, I'm seriously considering applying for euthanasia.

Incase I die of COVID-19 or some other ailment, especially because of the lack of proper medical treatment due to the unavailability of appropriate insurance cover, I give you my explicit permission to use the evidences provided here to prove that the Insurers are violating the IRDAI guidelines, that they are responsible for my death, probably for the death of other sick and disabled people.

Update 8th August

Reader Comments

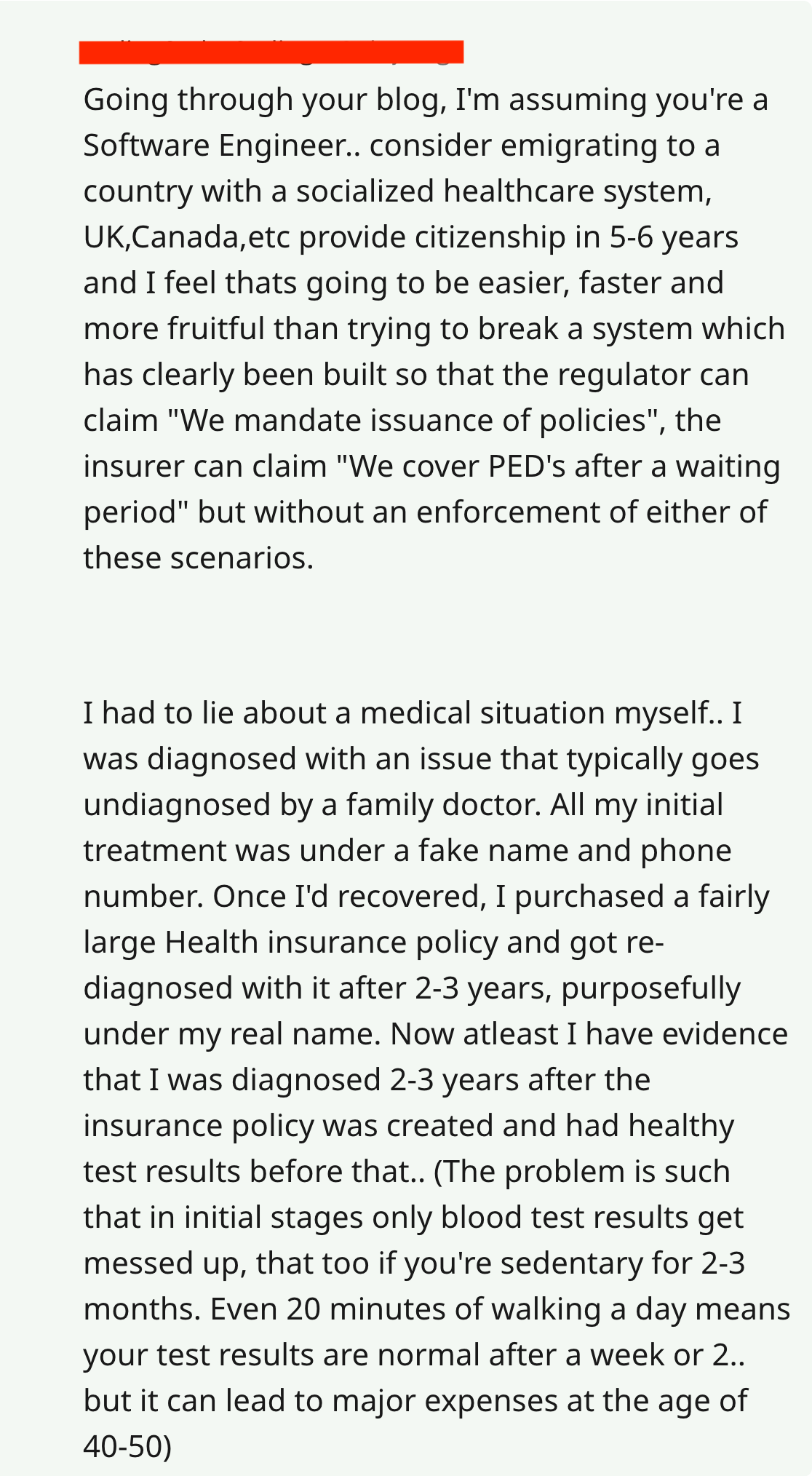

After I published this story, Several readers shared similar horror stories with insurers and the most common suggestion was to 'Lie about the preexisting illness'.

One user shared his/her/X extraordinary scheme to lie about preexisting illness for getting medical insurance and recommended me to immigrate to a country with socialized healthcare system.

By the way, I'm not a Software Engineer, at least not professionally anymore.

I had to explain other readers on why I wouldn't lie about by preexisting illness to the insurers.

What kind of environment are we creating for the sick and disabled, when only way to survive is to lie or immigrate out of the country?

If you are sick or disabled and in similar situation; I cannot tell you that you shouldn't lie, because it goes into the philosophical realm on morality vs survival. But keep in mind that if you lie to the insurer and if the insurer finds that out during your claim that you had a preexisting illness, your claim would be dismissed.

Corona Kavach

IRDAI has allowed the insurers to launch a COVID-19 specific insurance policies which covers COVID-19 treatment for a limited duration. I got inputs from the readers that the insurer they bought such policy from didn't ask about preexisting diseases.

Following their advice, I have procured a Corona Kavach Policy from Oriental insurance company which will provide coverage of about Rs. 5,00,000 (6,500 USD) maximum for 9.5 months if I need COVID-19 treatment. The insurer did not ask about preexisting illness for this COVID-19 specific policy.

But, Private hospitals are charging such amount for just 1 week of treatment, Further there are numerous reports of hospitals not accepting cashless facility offered by the insurer and ironically in certain states there are no upper limits for COVID-19 treatment costs at private hospitals if we use insurance.

A year later

It's been about a year since my ordeal with the insurers had begun. Respected news outlets like IndiaSpend have covered this story. So, you might wonder if there's any change in the attitude, policy of the health insurers towards those have disabilities?

The answer is NO.

IRDAI Grievances

My complaints to the insurance regulatory body IRDAI has been marked 'Attended to' or 'Closed' under false pretext i.e. not addressing the fact that I was not provided a insurance policy due to my disability.

I was asked by few readers why I did not approach couple of non-premium health insurers, My rationale was that if the premium health insurers who have partnerships with major international insurers don't care about rules, guidelines and ethics why would others?

Yet I decided to give few non-premium insurers an attempt.

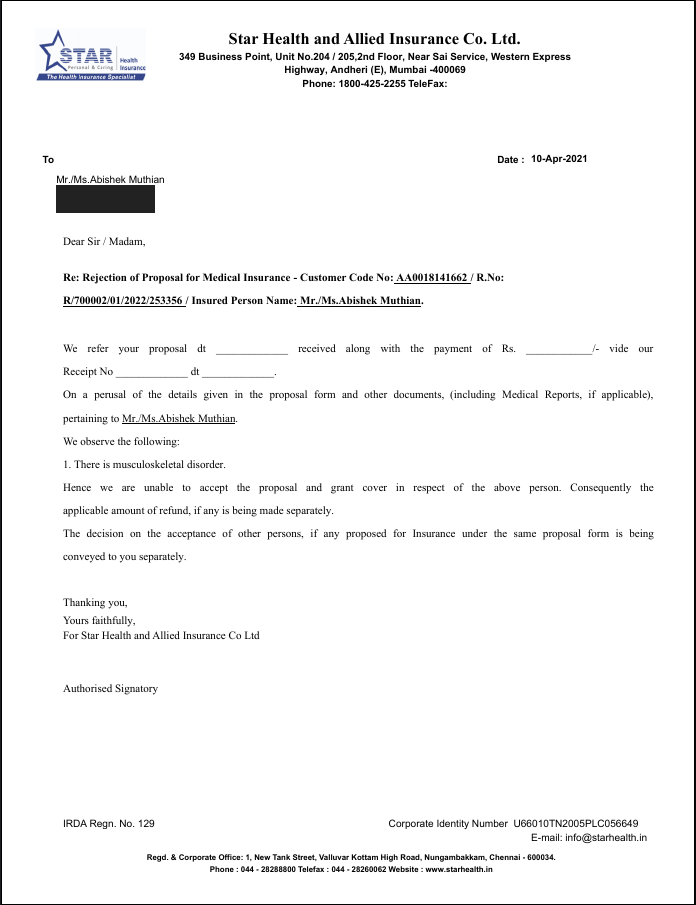

Star Health and Allied Insurance

As usual I explained in detail about my pre-existing illness to the agent over phone. I was assured that I will be given a policy after I upload my medical documents and make my payment. Which I did.

After two days I received this email,

They state the reason for rejection as 'musculoskeletal disorder'.

Say even if I suffer from musculoskeletal disorder, What about protection against cost incurred for treating other diseases in future? Am I only made of bones and muscles without heart, brain, kidney etc.(BTW, they all are proven health by the tests conducted by the insurer - Royal Sundaram above)

What about COVID? Should I just die if I'm not able to afford proper healthcare because I was denied health insurance sighting my other pre-existing disease?

SBI general insurance

SBI is the largest public sector bank in India. SBI general insurance provides health and other insurance facilities.

When I approached them for a health insurance policy, They asked me to lie about my pre-existing illness if I wanted to submit by application.

Take a listen -

Download the .mp3 file directly if you have trouble playing the audio

In spite of acknowledging that pre-existing diseases would be covered after 4 years, The agent asks me to lie about pre-existing illness for applying. Which of course I did not do.

Note: For both Star Health and SBI general insurance I approached them by asking for Indian Govt.'s mandatory health insurance policy - Arogya Sanjeevani, But I was talked out of that policy to their own policies by the agents.

What can you do?

Voice against inequality

• If you have policy with these insurers in India, Ask them why they are not providing policies to those who disclose their pre-existing illness.

• If you have policy with the insurers outside India who have partnered with insurers in India, Ask them how their partners in India are treating those with disabilities.

• If you are a journalist who is working for a media house who doesn't care about loosing insurance advertisement money i.e. actual journalism; Then ask these insurers data on 'How many applicants disclosed pre-existing illness' and out of them 'How many were denied their policy and why'.

• Ask the celebrities who endorse these insurers about how they feel about their actions towards those with disabilities.

If you are sick or disabled

Hang on, raise your voice, if you don't have one, there are others who will do it for you, including myself.

When applying for insurance,

• Disclose your preexisting illness thoroughly (Although it seems like the Insurers want us to lie about preexisting illness, so that they can deny our claim later when needed).

• Make record of every single conversation with the insurer including screenshots, screen-recordings, phone-call recordings.

• If the insurer denies you the policy citing preexisting illness instead of providing a waiting period or exclusions in accordance with the IRDAI's guidelines, raise a complaint on IRDAI's grievances cell.

• Share your experience publicly, tweet to me about it.

If you are from another country, I would still like to hear about how insurance for preexisting illness works there(good or bad) and how you are doing in general.

If you are 'healthy'

I'm happy you are. Unfortunately good-health isn't always guaranteed, that's why we go for an insurance, in fact my health reports from top hospitals when I was a child say "I am healthy".

If you want to help build a future where being sick or disabled is not just another factor for inequality, help us make our voice heard.

Update log

10-April-2021: A year later, IRDAI grievances status, Interactions with Start Health, SBI Insurance.

8-August-2020: Reader comments, Corona Kavach. archive

Newsletter

I strive to write low frequency, High quality content on Health, Product Development, Programming, Software Engineering, DIY, Security, Philosophy and other interests. If you would like to receive them in your email inbox then please consider subscribing to my Newsletter.